- Employment related securities: How to file an ERS return with HMRC

- What are employment related securities?

- Tax-advantaged ERS schemes

- Other ERS schemes

- What is an employment related securities return?

- ERS return deadline

- How to file an ERS annual return

- What information is needed?

- Prepare your annual return report

- Submit your annual return to HMRC

What are employment related securities?

Employment related securities (ERS) are gifts or awards of shares offered by companies to attract, retain or reward employees. There are different types of ERS schemes, some of which are tax-advantaged.

Tax-advantaged ERS schemes

There are four tax-efficient (or “approved”) share schemes available in the UK:

-

Save As You Earn (SAYE)

These government-led initiatives offer tax benefits for employers and employees, providing both parties meet the eligibility criteria and don’t exceed the grant limits of a particular scheme.

Other ERS schemes

The “other ERS” category covers any non tax-advantaged shares or securities. These arrangements are a useful alternative for companies that don’t qualify for (or have outgrown) the UK government-approved schemes, as well as those that want to incentivise employees based outside the UK.

Other ERS schemes include, but are not limited to:

-

“Unapproved” options

-

Joint Share Ownership Plans (JSOPs)

What is an employment related securities return?

An ERS return is a compulsory annual filing submitted to HMRC by companies that grant employment related securities (such as shares or options) to their employees. The purpose of an ERS return is to report any share-related activity that happened in the previous tax year, including one-off awards or gifts of shares.

ERS return deadline

The company secretary (or acting company secretary) must complete an online ERS return on or before 6 July following the end of the tax year, which runs from 6 April to the following 5 April.

If you fail to meet this deadline or you file an incorrect ERS return, your company may have to pay a penalty. Any employees participating in an approved ERS scheme could also lose their equity-related tax advantages.

How to file an ERS annual return

You’re required to submit a separate ERS return for each scheme you’ve registered with HMRC. An essential part of this process is preparing an annual return report (or reports), detailing your company’s equity-related actions from the previous tax year.

If you have no activity to report or there are no outstanding qualifying options (for EMI or CSOP), you simply need to file a ‘nil’ return.

What information is needed?

The information included in your annual return report depends on the type of ERS scheme and your company’s specific circumstances.

If you’re filing an EMI, CSOP or SAYE return, you’ll need to provide details such as:

-

The dates of any new option grants and the number of grantholders concerned

-

The unrestricted market value (UMV), actual market value (AMV) and exercise price per share

-

Your HMRC valuation reference, if the market value was approved before issuance

-

The date and tax implications of each option exercise, release, lapse or cancellation

→ Learn how to file an EMI annual return with HMRC in our step-by-step guide.

SIP returns are used to report on the movement of shares “in” and “out” of the plan, covering:

-

The type of shares awarded (e.g. free, matching, partnership or dividend shares)

-

The UMV (per share) and the total value of shares upon acquisition

-

The number of employees who met the individual grant limit, and how many exceeded it

-

The number and UMV of each type of share that was removed from the plan

-

The date and tax implications of each withdrawal event

The reports for other ERS schemes typically require more extensive employee, company and grant details. You may also need to disclose any non-standard activities, such as securities acquired for less than market value or adjustments made due to non-UK residence. However, you only need to share information on the ERS arrangement or event that applies to your company for a particular tax year.

Prepare your annual return report

You can download the relevant end of year return templates from the UK government website and input your information manually, following the guidance notes provided by HMRC. This process will typically become more complicated and time-consuming as your company grows – especially if you award equity to overseas employees.

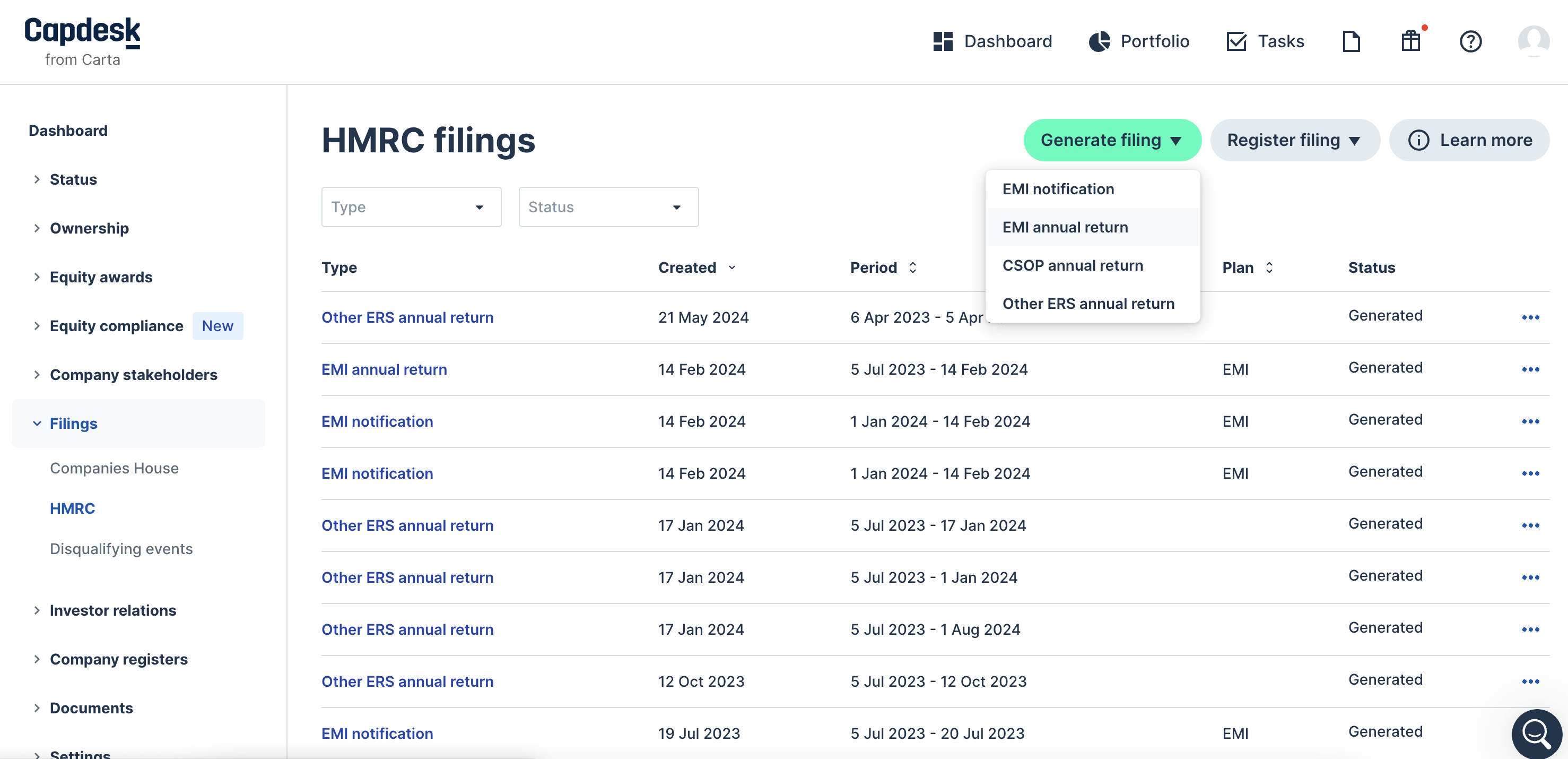

Alternatively, if you’re a Carta customer, you can export an annual return report from our platform in just a few clicks. Log in to your account and select ‘HMRC’ under ‘Filings’ in the left-hand navigation bar. Click the ‘Generate Filing’ button and choose between ‘EMI annual return’, ‘CSOP annual return’ or ‘Other ERS annual return’.

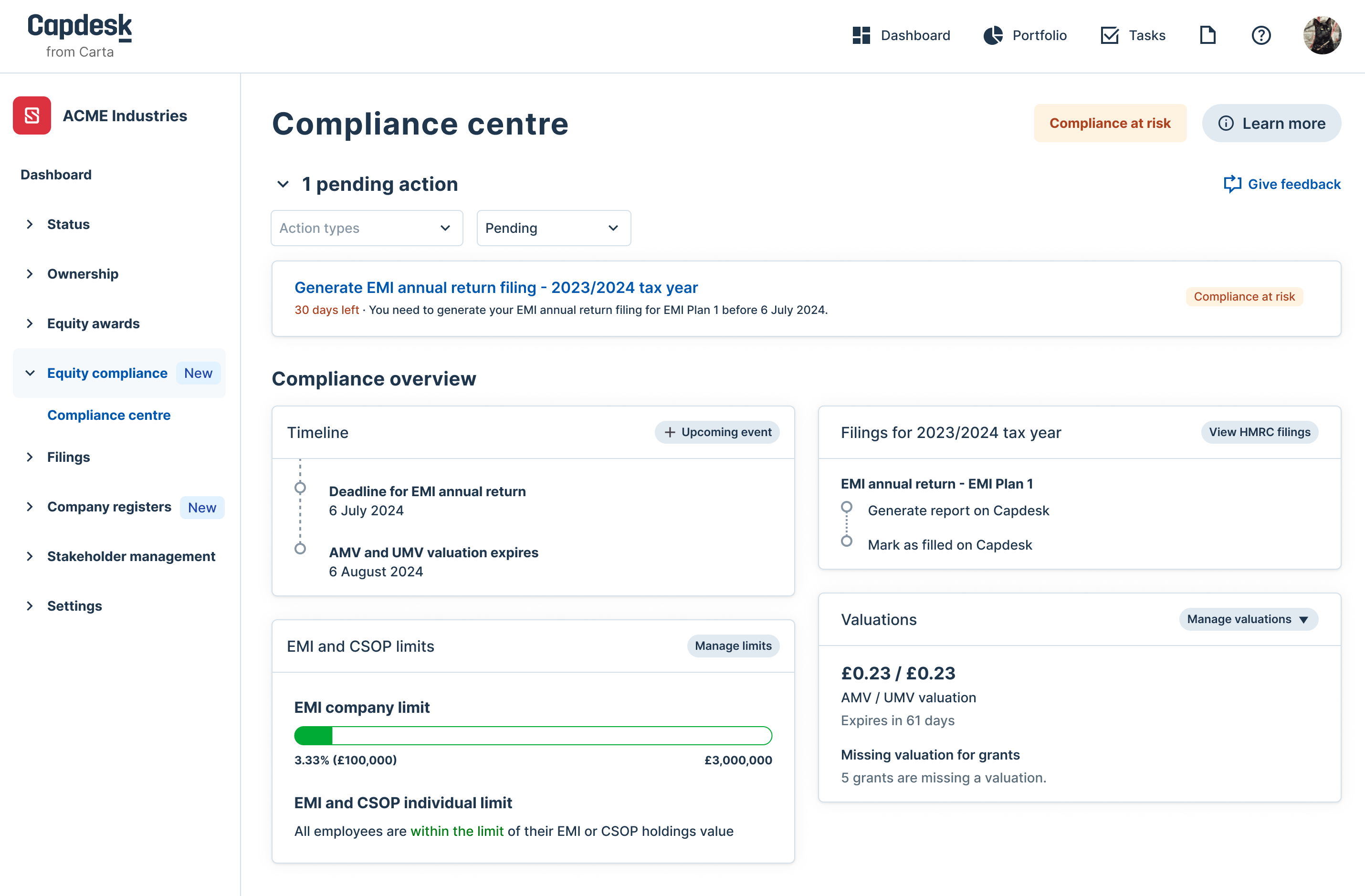

If you’re not sure which annual return report you need to generate, head to the compliance centre (also found in the left-hand navigation bar). The platform keeps track of all your equity issuances and previous HMRC filings, notifying you of upcoming deadlines and expiring valuations. Any annual return filings that are due will be shown in your account as a ‘pending action’.

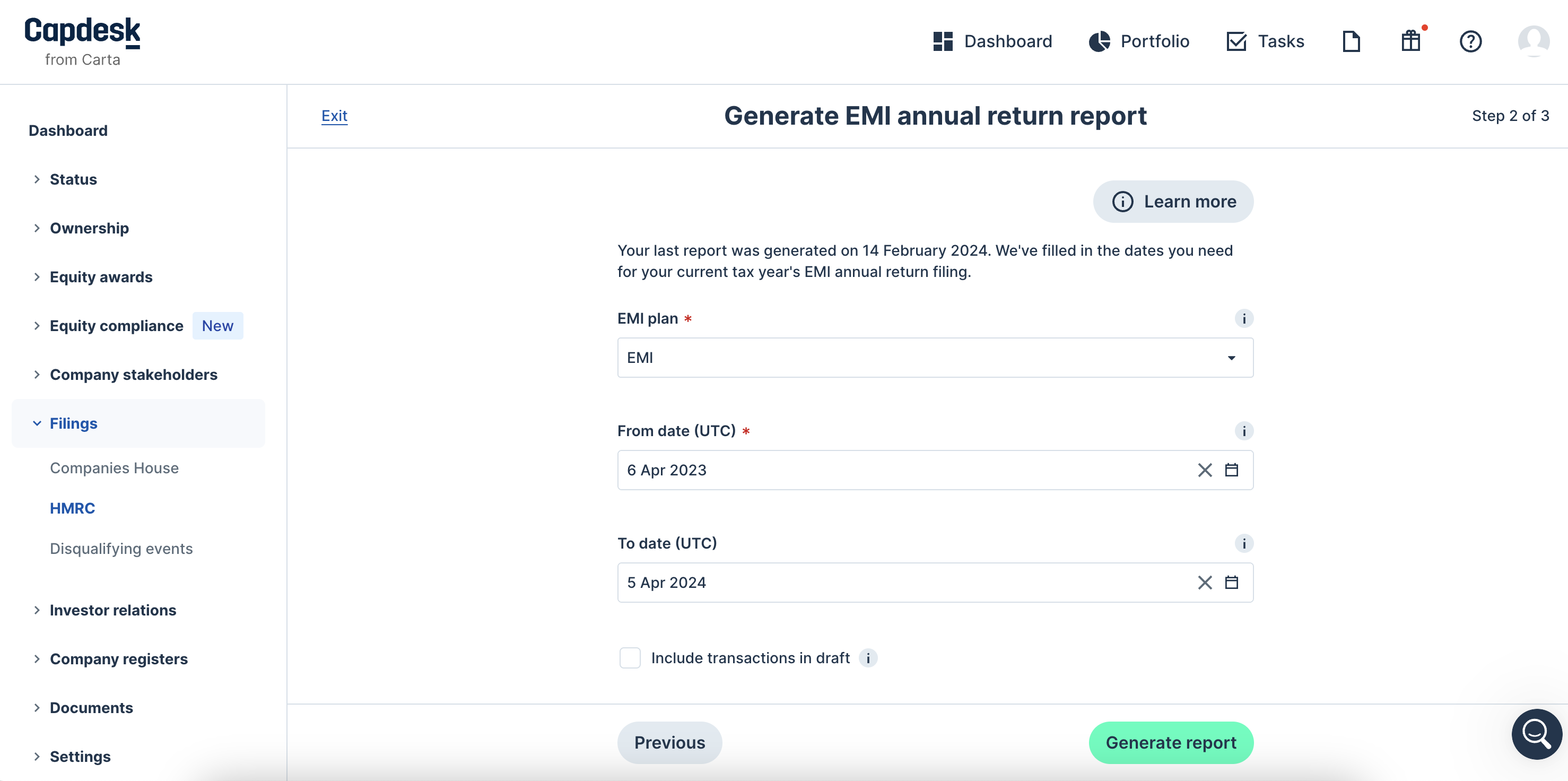

The start and end dates for your current return will be automatically filled in, and should reflect the previous tax year (from 6 April to the following 5 April). You can also see when your last report was generated, if applicable.

After you click ‘Generate report’, the file will be automatically populated with your company’s cap table data and sent to your email inbox as an OpenDocument Spreadsheet (ODS). All you need to do is review it, add any missing information and then upload it to HMRC as part of the following process.

Submit your annual return to HMRC

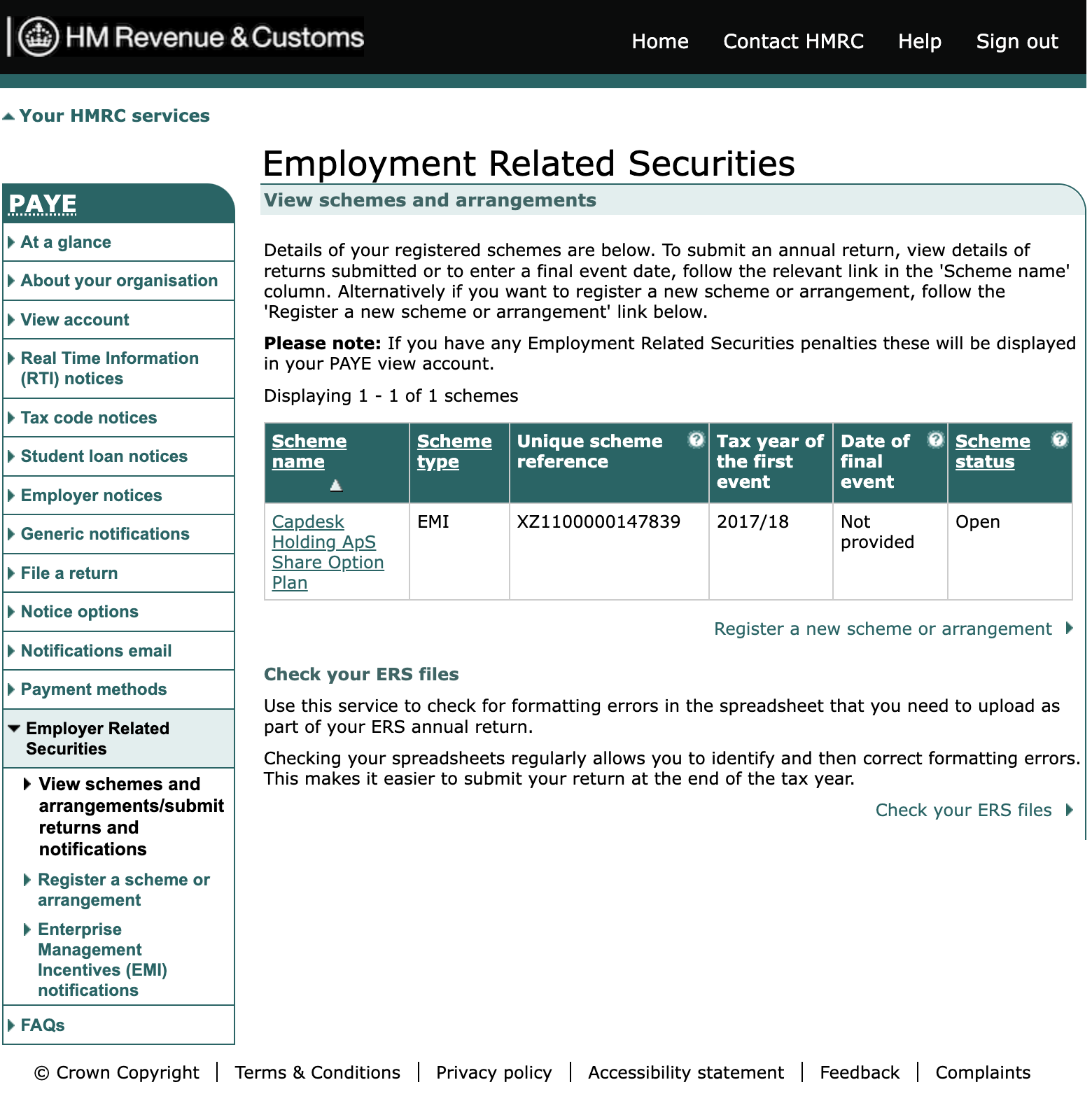

Once you’ve prepared the relevant report (or reports), you need to submit your annual return via the HMRC online portal. To sign in, use the Government Gateway ID and password you received when registering your scheme with HMRC.

Navigate to the ‘Employer Related Securities’ section and click ‘View schemes and arrangements/submit returns and notifications’. If you have more than one scheme, you’ll need to file your ERS returns one at a time.

Select the relevant scheme and then follow the on-screen instructions to complete the filing process. You’ll be prompted to enter your company details and upload the annual return file you prepared earlier. Note that HMRC will only accept files in the format of comma-separated values (CSV) or OpenDocument Spreadsheet (ODS).

Once you’ve reviewed and submitted your return, you should see a confirmation message containing a reference number. If you’re a Carta customer, you can use this reference to mark your annual return as ‘Filed’ in the platform. This will help you keep accurate and up-to-date records of all your HMRC filings.