- Syndicates

- What is a syndicate?

- How does a syndicate work?

- Why would an investor invest in a syndicate?

- Pros

- Cons

- Why lead a syndicate?

- Pros

- Cons

- Challenges when building a syndicate

- A framework for valuing syndicates

- The carried interest argument

- Improving your odds

- Syndicate "auto scaling"

- The "cold start" problem

- "Non-obvious" syndicate question

- Building LP Networks

- Deal flow and diligence

- Deploying capital

- Fund vs. syndicate dynamics

- "Must know" syndicate skills

- The deal lifecycle

- Deal marketing

- Funnel management for syndicates

- Hard-earned feedback from the battlefield

What is a syndicate?

A syndicate is like a deal-by-deal venture capital firm. Syndicates are run by a lead and funded by angel investors or high-net-worth people (referred to as a limited partner or LP). A syndicate lead may work with the same investors across deals, but they may not be the same for each deal because LPs might opt in or out. Each startup investment is called syndicate deal or a special purpose vehicle (SPV).

How does a syndicate work?

-

You discover an early-stage startup that you think is set for growth.

-

You talk to the founder and manage to secure an allocation of $150k in their fundraising round.

-

You set up a deal-by-deal investment vehicle (called an SPV).

-

You then set about fundraising for that SPV, hoping to fill as much of your allocation as possible.

-

The SPV then invests all of its funds in the startup.

-

When you exit, the funds are allocated as per the structure of your waterfall. Typically this means that investors get 100% of their funds back, and then split the remaining amount 20% for yourself and 80% for your investors.

Why would an investor invest in a syndicate?

Pros

-

Look at more deal flow: If you back 5 syndicates, and they do 2 deals a month, you're gonna look at 120 deals per year

-

Invest smaller tickets: You're starting out and want to write $1k-$5k checks, which most founders won't take immediately. Through a syndicate, you can write smaller checks.

-

Be part of the ecosystem: Meet new people, network with founders and other angel investors

-

Fees: Often no management fee vs investing in a fund

-

Flexibility: Ability to opt into deals that you’re excited about and pass on those you’re not

Cons

-

Lots of work: It's not like investing in a fund and relax, you need to review all deals you are receiving

Why lead a syndicate?

Pros

-

Increase your return by 5x: If you usually invest $5k per startup and you find a deal that your network invests $45k in alongside you with 20% carried interest, you’ll get considerably more upside- do the math!

-

You can do it part-time vs managing a fund which is way more time consuming. If you are busy, you can simply not make any deals.

-

Opportunity to build a track record to launch your fund in the future

-

It's easier to convince LPs to invest in a startup than in your fund.

Cons

-

Lots of work – you’re fundraising for every single deal vs a fund where you fundraise every 2 years

Challenges when building a syndicate

Running a syndicate is not an easy task and the road to success is long. The best syndicate leads work tirelessly on sourcing and performing due diligence for new tech companies to invest. That level of commitment and effort deserves fair compensation.

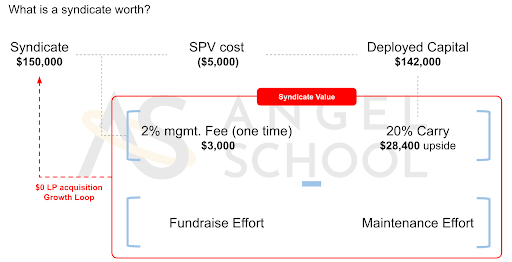

A framework for valuing syndicates

Let’s start with a framework for how to value a syndicate from the perspective of a syndicate lead.

It’s not just about sustainability. The right structures align the interests of syndicate leads with the LPs that they serve. LPs back a syndicate’s deals and are their source of capital.

Syndicate leads can easily structure management fees and carried interest on Carta. Carried interest (or carry) is the share of profits the syndicate receives upon a successful exit. For example, a syndicate can charge a one-off management fee of 2% and 20% carried interest. In this case, a $150,000 raise results in $3,000 of fees and an upside worth $28,400 net of SPV costs for the syndicate lead.

The right tech stack and SPV help from services like Carta streamlines your operations. Fundraising and maintenance effort should only marginally increase while your capital deployed and upside grows.

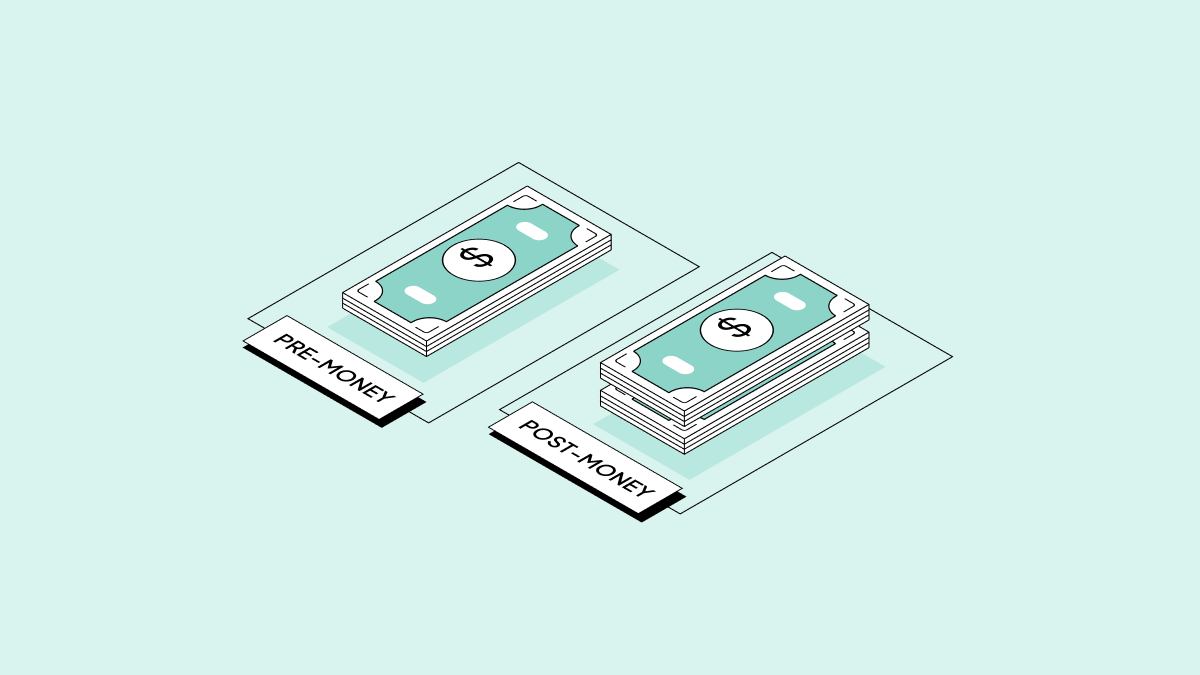

The carried interest argument

Earning carried interest is one of the big motivators for angels to start a syndicate. Creating a syndicate also helps you support founders with your angel network, build a track record and meet minimum ticket amounts. Carried interest gives angels an upside on capital greater than writing a personal Angel check.

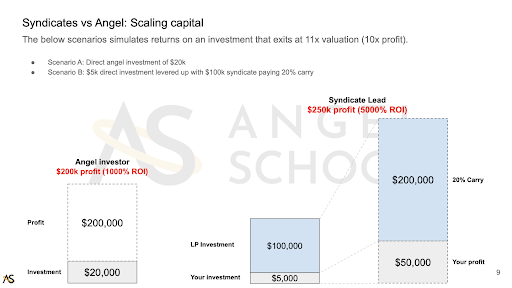

Imagine you invested in a company that exits at a 11x return (or 10x profit).In scenario 1, you made a direct angel investment of $20,000. In scenario 2, you invested $5,000 personally and raised a syndicate that deployed $100,000 and charged 20% carry.

Scenario 1: As an angel, your $20,000 investment generates a $200,000 profit or 1000% ROI.

Scenario 2: You would receive $50,000 on your own capital and $200,000 in carried interest. You generate $250,000 of profit on $5,000 capital at risk or 5000% ROI. This simple example shows how scaling capital and receiving carry improves the upside for syndicate leads.

Improving your odds

Another way of looking at the benefit of scaling capital through a syndicate is that it improves your statistical outcomes. Writing a larger check and charging carry can help you generate meaningful financial returns from modest outcomes.

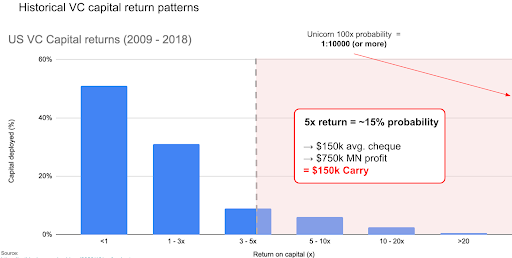

Here’s some data showing historical VC capital return patterns in the US. It’s a proxy for investor performance.

The data says that the probability of getting a 5x return on a venture investment is about 15%. If you’re able to grow your LP network to an average syndicate check of $150,000, that’s a 1:6 chance for $150k in carried interest.

An active syndicate might do 6 - 10 deals a year. In 2 years, you’ll have invested in 2 - 3 winners with an expected carry value of $300 - 450k.

By contrast, getting a 100x return is an amazing outcome but statistically, that’s a 1:10000 event. It’s an outcome so rare that few ever achieve it.

Syndicate "auto scaling"

One of the great things about syndicates is that there are built-in growth levers. Gain the trust of your LPs and find the best possible deal flow for them, and they’ll become your advocates.

They’ll be telling their peers about your syndicate, sharing your deal flow and offering to make introductions. When it starts to happen, what seems like random noise is a sign you’re on the right track. It’s the beginning of a tailwind that will auto-scale your LP network.

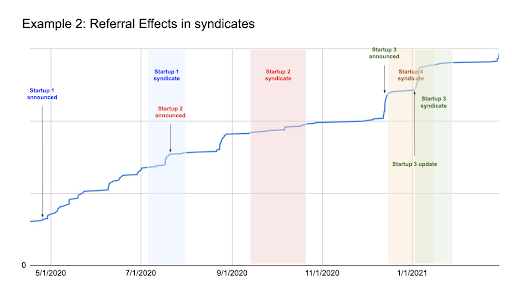

I noticed this pattern in 2020 when I had ~150 LPs and decided to backtest the hypothesis. I constructed this data using my CRM, email inbox and calendar events.

The blue line in the chart tracks the number of investors on my mailing list. There’s a clear correlation between deal flow activity and growth in my network. That’s the referral effect!

When I realized this pattern existed, I shifted my attention entirely to finding the best possible deals to invest in. I’ve relied on this growth pattern to go from 200 to 1000+ LPs. Today, I never go looking for LPs. They all join my syndicate as warm introductions.

The "cold start" problem

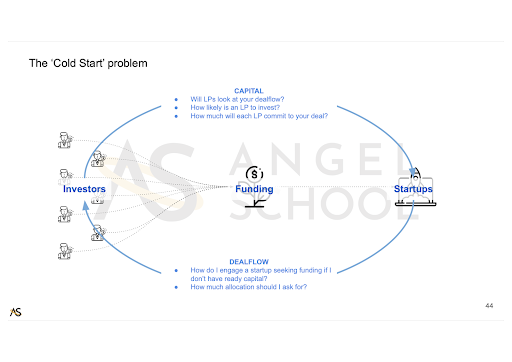

There’s a "chicken and egg" problem when you’re starting your syndicate. Should you find LPs first or find a startup to invest in? Even if you had both, you still can’t "make the market." That’s because there are underlying variables that are out of your control.

Having an LP network doesn’t assure you of capital because you don’t know who will look at your deal flow. LPs control the investment and capital allocation decisions in syndicates so you don’t know who will invest and how much. On the other hand, startups will want how much allocation to hold for you.Without a better way to solve this, your outcomes are suboptimal. Your can over index on building your LP network to meet the fundraise resulting in wasted time and effort. Or, you can be conservative and seek a lower allocation, thereby leaving capital and upside on the table.

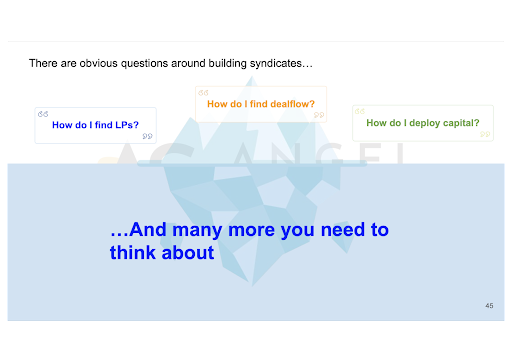

"Non-obvious" syndicate question

The 3 most common questions I get asked by aspiring syndicate leads are:

-

How do I find LPs?

-

How do I find deal flow?

-

How do I deploy capital?

They’re important questions for sure. However, each of these questions break down into dozens of non-obvious drivers and considerations. When there are that many factors at play, suboptimal decisions compound leading to a lot of inefficiency in our syndicate’s performance. We think obsessively about all this because we believe there’s a science to building syndicates.

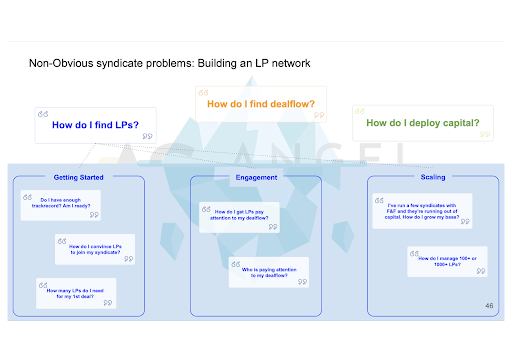

Building LP Networks

When you’re building your LP network, here are some questions you should be thinking about.How do you profile and target the right LPs for your syndicate? How do you convince them to pay particular attention to your deal flow above other sources? How do you know who’s engaged or not? Growing your LP network is also important. After all, if you return to the same investors time and time again, you’ll dry out your capital pool. On the other hand, how do you manage 10s, 100s or 1000s of LPs? This requires a scalable way to distribute deal flow, of nurturing interest and closing capital.

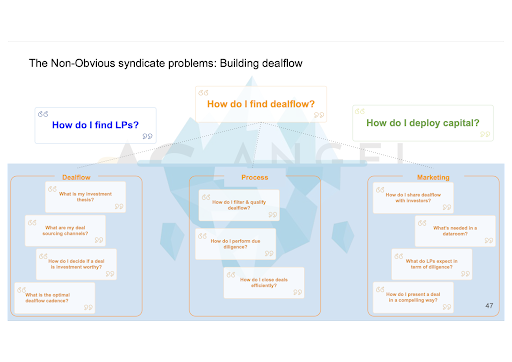

Deal flow and diligence

Syndicate deal flow and diligence is a step change from angel investing off your own balance sheet. You’re now influencing LPs’ investment decisions and becoming a custodian of their capital. A number of interesting challenges arise from this evolution. For example, what does good "due diligence" look like? Once you complete diligence on a company, how do you ultimately decide whether to move forward with syndicating a deal?Finally, as a syndicate lead, your mandate is to "sell" an investment opportunity to LPs. So, what does marketing for syndicates look like?

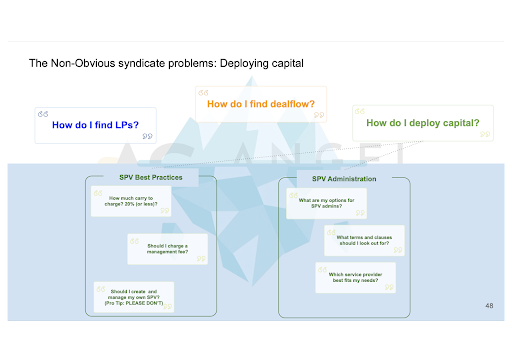

Deploying capital

Finally, when you’re able to "make the market", you need to deploy that capital. Should you manage the investment in-house using your own Corp Secs, tax accountants, and legal service providers or rely on SPV admins? What should you charge for syndicate fees and carry structures? Selecting the right SPV admin is also an important long term decision. What are your options? Who best fits your needs?

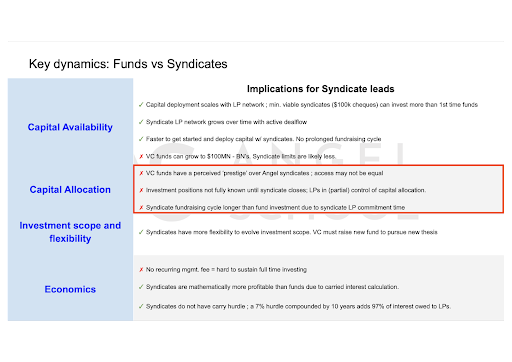

Fund vs. syndicate dynamics

Finally, let’s look at some scenarios where syndicates are less effective. We’ll do this by contrasting them against fund structures. There are 3 areas where syndicates may be disadvantaged compared to funds.

There’s a pecking order in venture capital. After all, startups talk about being VC-backed rather than funding from angel groups. It’s likely the case that syndicates don’t get equal access to deal flow even if they could write similar sized checks.

Second, syndicate LPs control investment and capital allocation decisions. As such, syndicates never know for certain how much allocation they’ll fill until all the commitments are in. That said, we’ve developed techniques for managing this.

Finally, syndicates don’t sit on dry powder. We only publish deals to LPs after diligence on a company is complete. Fundraising takes place after that. As such, the syndicate investment timeline is always longer than a fund. That makes it harder to pursue deals on a short timeline.

"Must know" syndicate skills

Here are a few "must know" techniques for getting every bit of performance out of your syndicate.

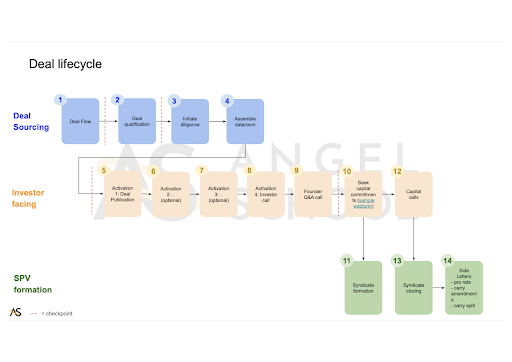

The deal lifecycle

Running an investment through the syndicate model has some unique characteristics. Unlike angel investing, they require a more efficient and thorough diligence process. LPs also need help with decision making so you’ll need a data room as well. You’re fundraising for each company after you decide to back a company. Funds on the other hand, have a prolonged upfront fundraising cycle but then have a pool of dry powder to deploy from. These differences mean that syndicates need their own process for managing the deal lifecycle. We’ve developed one that is segmented into 3 tracks.

The deal sourcing track is a continuous, iterative process of sourcing deals, qualifying them, performing diligence, and compiling data rooms.

The investor facing workstream is about deal marketing. Our objective here is to maximize LP engagement and close capital commitments.

The SPV formation track is about moving capital. This involves setting up legal entities and investor governance, receiving and wiring capital, and administration like pro rata rights and carry share agreements.

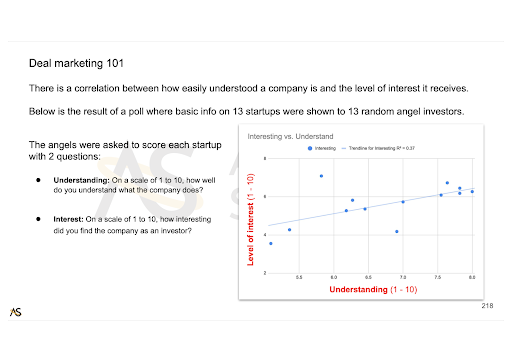

Deal marketing

Deal marketing is an essential skill and one unique to syndicates. Great syndicate leads must be great at presenting startups to investors in a way that is easy to understand, representative of the deal, while being compelling enough to generate interest.

It’s a delicate balance to achieve and absolutely critical. In our experience, 80% of your LPs’ interest in a deal comes from the very 1st touchpoint (step 5 in the deal lifecycle). You have only one chance to get this right.

Our objective when introducing a deal is to build interest. The "win" is to lead them to a pitch deck or data room to move them towards an investment decision.

To achieve this, your primary goal is to ensure LPs understand the company does, then to get them excited about it. After all, you can’t get someone excited about something they don’t understand in the first place.

We recently did a study where 13 random angels were invited to present a startup to their peers. After each presentation, we conducted a poll that asked 2 simple questions:

-

How well did you understand the company? (horizontal axis above)

-

How interested are you in the company? (vertical axis)

We found a clear positive correlation between the level of understanding and level of interest. So how do we optimize for understanding and interest? What does that look like?

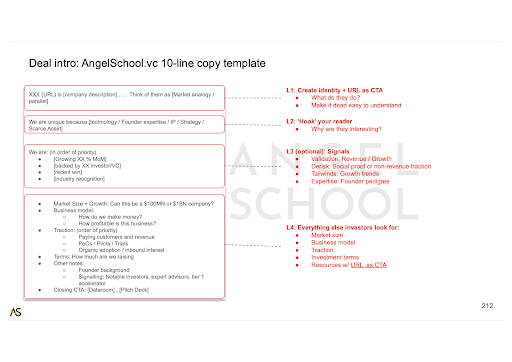

If you’ve got even a modest LP network, you won’t be able to reach out and pitch them one by one. You’ll need to broadcast this to everyone using email, a notion page or something.

So in addition to understanding and interest, we’re restricted to plain text.

To arrive at this answer, I looked at hundreds of emails and messages from Founders reaching out to me. I also studied tons of communications between investors.

What I noticed is that investor communications are far more structured and succinct. They also contain standard sets of information. I surmised that investors have a lingua franca - a common way of communicating deals with each other. It only makes sense to communicate to investors in this language that they understand.

Based on this, we developed our own 10-line framework for introducing deals to LPs. It optimizes for ease of understanding, then building interest.

Funnel management for syndicates

When investing through syndicates, LPs decide which deals to invest in and how much. This introduces an element of unpredictability for fundraising. This is the ‘optimization problem’ in syndicates. The optimal allocation you should seek in a startup is exactly how much appetite there is in your LP network.

However, as we’ve explained, you don’t know what this is. If you overestimate allocation, you’ll be scrambling to fill it or hurt the startup by missing the raise. On the other hand, if you stay conservative and underestimate allocation, you’re leaving capital on the table and sacrificing upside. How do you solve this?

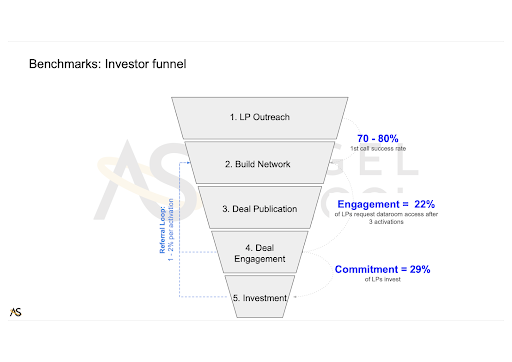

We’ve developed a funnel management approach to running syndicates. It’s appropriate to borrow a concept from sales since a syndicate is in essence a deal-by-deal investment opportunity. You’ll find our 5 stage funnel definition below. We then measure our conversion metrics across our funnel using actual deals and developed the below benchmarks.

We have produced consistent metrics deal after deal and assume and recommend the following conversion benchmarks:

-

New LPs to join your mailing list: 70 - 80% success rate

-

Deal Engagement: 22% of LPs should express interest in a deal after a marketing effort

-

Deal Commitment: 29% of engaged LPs end up investing

Funnel management techniques combined with best practice benchmarking offers a way for syndicate leads to predictably close capital and optimize allocation.

Hard-earned feedback from the battlefield

Diego Camilleri eSeed.vc

-

Automate as much as possible. I use Mailerlite, Docsend, Notion, Asana, Pipedrive, Zapier and Carta to automate my back-end. I now spend less than two hours per deal on admin tasks.

-

Launch with an MVP mindset: Don’t overthink it, just define your investment thesis, find a few good deals and start onboarding investors.

-

Syndicates have network effects, so if your members like the deals you share and how you run your syndicate, they will be the ones bringing new members. In my case, around 90% of new joiners are people I have never met but come from referrals.

Matt Ward, 4ward.vc

-

Start as a venture scout: Find great deals and refer them as a scout to other syndicates or VCs to build up a track record and karma

-

Work with existing syndicates to co-syndicate their deals to your LP base (which helps you with getting some carry share on great deals and also testing your LP base's willingness to invest).

-

Join other syndicates to get a better idea for how things work and also build your investor portfolio.

Aksel Piran, CP3 Ventures

-

The most surprising part about the first deal we did was the speed at which it happened. We collected interest over three weeks and as it was a hot crypto deal in the middle of the crypto boom early 2020. It was so much more successful than I ever could have imagined.

-

It's a beautiful experience overall and takes your business angel journey to the next level. An amazing way to enlarge your circle of like-minded friends, entrepreneurs, C-level managers and professional investors, that will be your treasure trove!