Private equity investors know the importance of waterfall modeling. It might be the closest thing they have to a crystal ball—a key tool for projecting different exit scenarios for their portfolio companies, estimating the value of equity held by employees and executives, and calculating quarterly valuations to report back to LPs.

Private equity investors also know the pains of waterfall modeling. Most firms assign waterfall modeling duties to their associates, who spend weeks crafting bespoke models in Excel for each company in the fund's portfolio. To build these models, associates must manually parse and combine a company’s operating agreement and cap table, which are often complex and disconnected. The firm’s finance team and executives must wait for these models and then familiarize themselves with each of them. When an associate leaves the firm, their knowledge of the models leaves too.

The time that associates spend creating, learning, and re-learning waterfall models isn’t the only problem with the process. Too often, manually building waterfall models can be painfully prone to human error.

That’s where Carta comes in. Our new tool for PE waterfall modeling solves the problem in the way we know best: by taking a messy, tedious, and manual financial process out of Excel and replacing it with software and automation. Our waterfall modeling solution for PE firms gives investors and companies more time to spend on the parts of their business that matter most.

A new approach to PE waterfall modeling

Carta has offered startups and their investors a tool for modeling waterfalls for many years. But that tool was built primarily for the venture capital sector, where agreements governing payouts tend to be relatively simple. The agreements that govern payouts among private equity firms and their portfolio companies tend to be much more complex. We decided to build a new product to streamline and automate waterfall modeling in a way better suited to meet the PE industry’s specific needs.

It started with research. Our engineering team first spent months learning everything we could about waterfall modeling in PE. Alongside industry experts from our valuations team, we dove into the nitty-gritty of PE operating agreements and started thinking about the best ways to translate all of their complicated liquidation preferences into the language of software.

After exploring the key aspects of waterfall modeling, our next task was to make sure we fully understood the strengths and weaknesses of Carta’s current approach. We reverse-engineered Carta’s existing waterfall modeling tool from scratch, absorbing the intricacies of how it works and probing for ways to make it more powerful.

Then, we began to experiment with some of the more intricate waterfall agreements that partner private equity firms shared with us. When there were terms that the model hadn’t before encountered, we wrote new code to fill the gap. But as the number of bespoke deal terms added up, this approach of adding new instructions for each new term grew more and more inefficient.

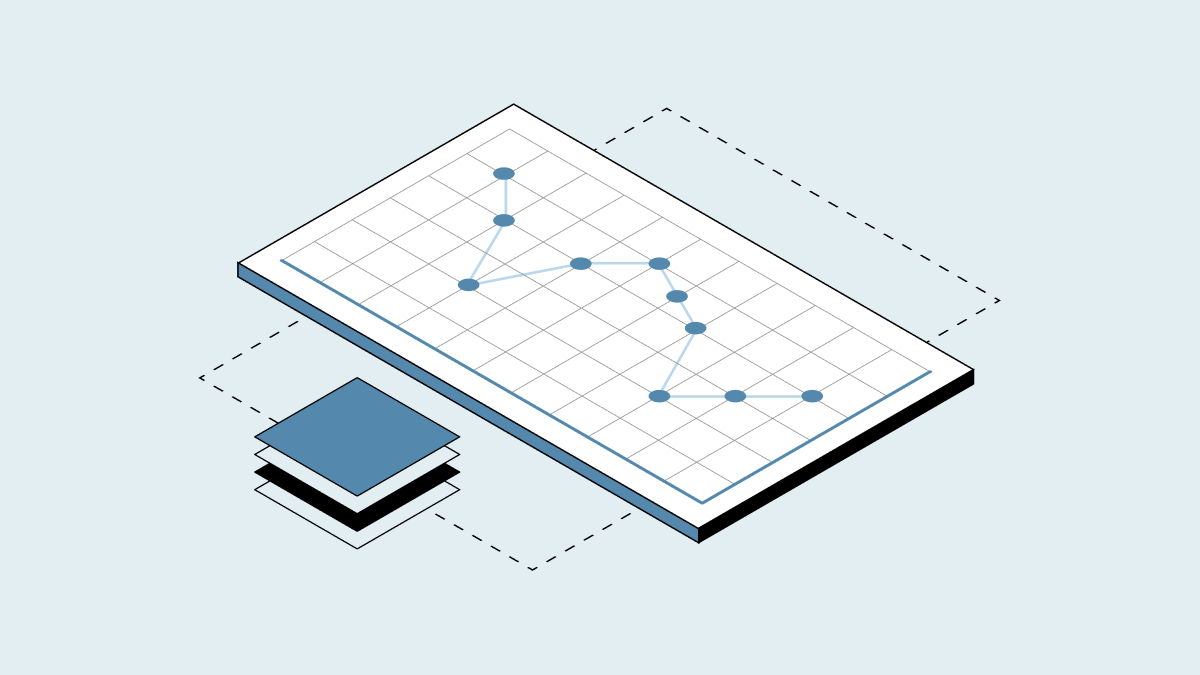

That prompted us to take a different direction. Instead of developing a tool that could recognize every possible type of waterfall—a potentially endless task—we decided instead to let users define their own waterfalls using a menu of potential options for a variety of deal terms and waterfall breakpoints. Recognizing that PE firms and their portfolio companies often employ unique terms, we made these components customizable, to create a flexible, user-driven tool that can adapt to each firm’s particular needs.

How it works

To make this new approach possible, our engineers developed a new grammar for the PE waterfall modeling tool: a system for rephrasing the complex language of operating agreements into simple, conditional statements. With this framework established, the process of building new waterfall models is straightforward. Investors and companies simply submit their operating agreements to Carta, and our engineering team translates and encodes the terms of the agreement into our modeling engine.

After Carta enters a company’s operating agreement into the system, accessing a waterfall model is simple. Users input a few key variables into the Carta app—the company’s total equity value, the date of the valuation, and the appropriate vesting treatment—and the model provides a complete, accurate rundown of how the waterfall will proceed down the capital stack.

At first, many of the private equity firms we spoke to about waterfall modeling were skeptical that software could effectively handle their most labyrinthine operating agreements. So we put out a call for the most complicated waterfall models that investors could find. It was an ideal way to push the tool’s boundaries. It passed every test.

Carta’s new waterfall modeling tool is customizable. It’s client-tested. And it’s also connected. The tool is exclusive to companies that maintain their cap tables on Carta. This allows each company to link its waterfall model to its cap table, ensuring that all shareholder data is up to date at all times and eliminating the errors that often arise when these key documents are located in different places.

We’re launching the new waterfall modeling tool to the general public this month. Now, private equity investors and their portfolio companies have another option for generating waterfall models besides assigning them to their greenhorn associates—and there’s no chance that Carta’s tool is going to leave the firm after two years and go to business school.