At Carta, we’re building an ownership network that changes how assets are acquired, valued, and transacted. To propel Carta forward, we just raised our Series E.

Here are the details:

-

We raised $300 million at a $1.7 billion post-money valuation.

-

The round was led by Andreessen Horowitz, and also includes Lightspeed Venture Partners and Goldman Sachs Principal Strategic Investments.

-

Marc Andreessen is joining our board.

-

Previous investors including Tribe Capital, Menlo Ventures, and Meritech, as well as new investors Tiger Global Management and Thrive Capital, also participated in the round.

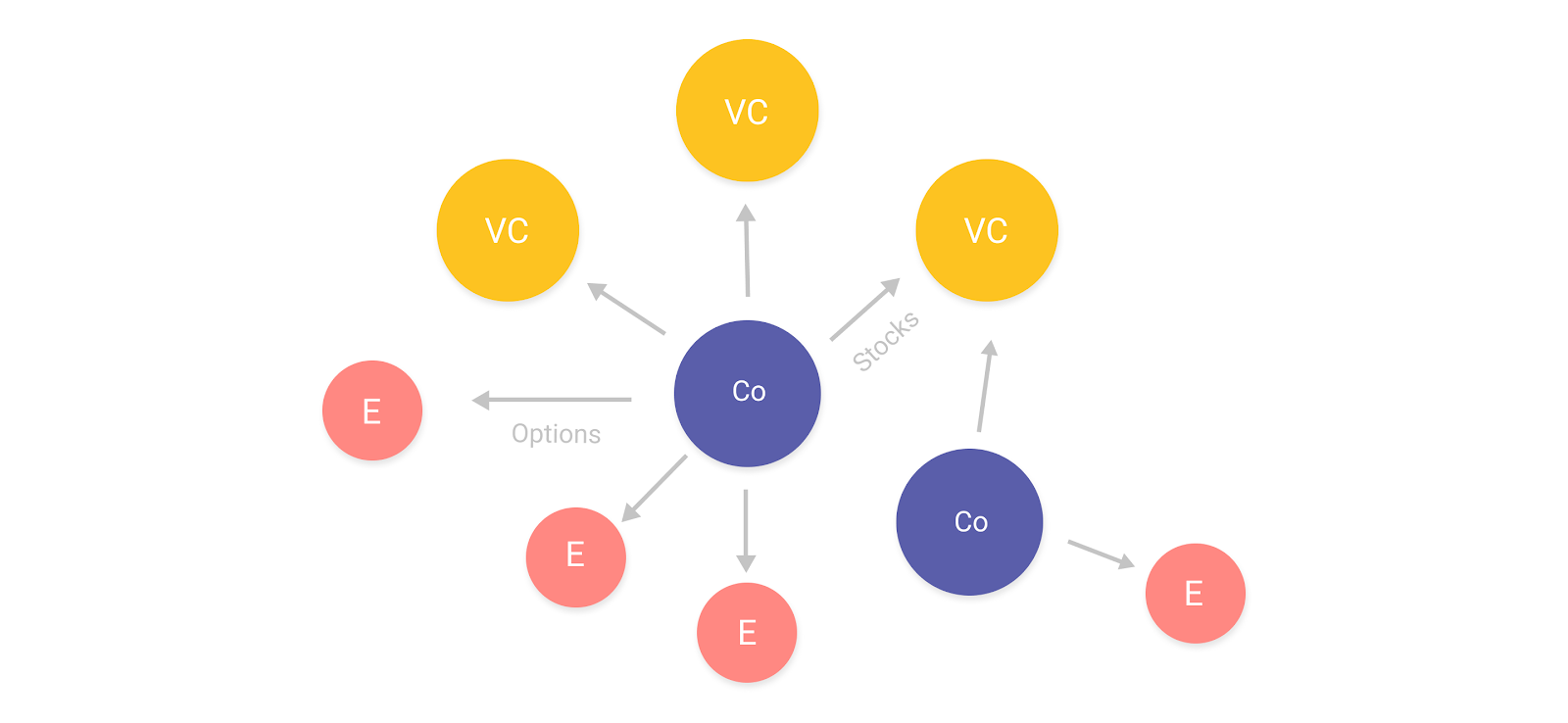

From issuing securities…

Carta started with this question: Why can I buy Google stock on my phone, but investing in a private company costs $20K in legal fees, takes 45 days to close, and ends with a mailed paper stock certificate?

In 2012, we began tackling this problem by offering an easier way to issue securities. When companies issue securities, we automatically track equity details on cap tables. Through our products for private companies, we reach venture capitalists and employees, laying the foundation for the ownership network. More than 11,000 companies and 700,000 shareholders (investors and employees) are now on Carta.

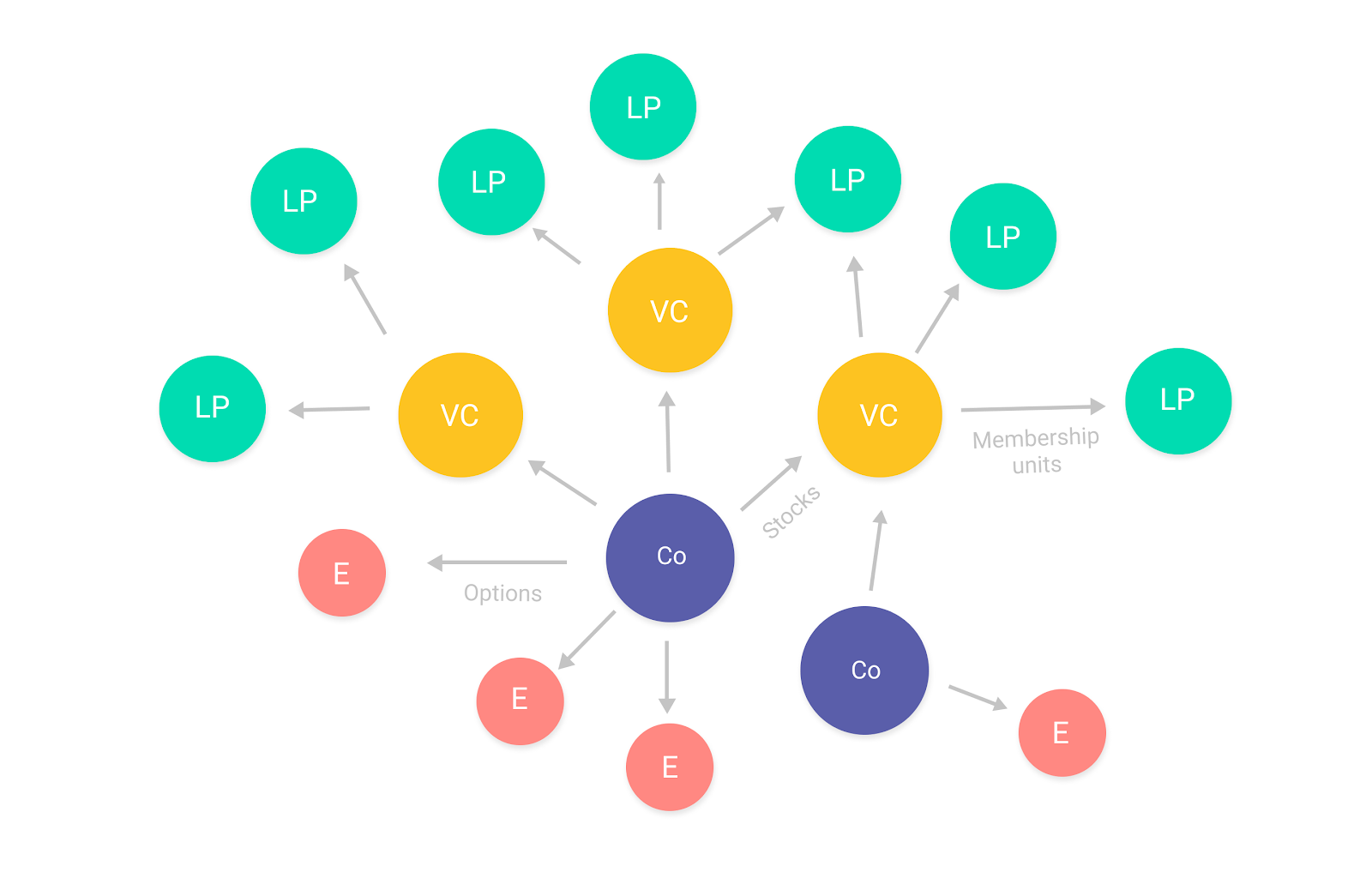

…To modernizing how investors manage their funds

In addition to giving venture capitalists an easy way to accept securities and request cap table access from their portfolio companies, we’re also fixing the antiquated system of fund administration. We launched our fund admin business in mid-2018 and already have $9 billion in assets under administration on Carta.

VCs come to Carta for full-service fund administration, a real-time platform for portfolio management, and a simple, secure way to share information with their limited partners. This expands the ownership network by extending our reach to LPs, more VCs, and more companies.

In total, we now have a registry of $575 billion in assets and our ownership network and ability to acquire assets is growing faster and faster.

…To changing how capital markets work

We’ll use our new funding to enable liquidity across our network. Private markets are so illiquid that founders and employees often wait a decade for an IPO to earn money from their equity. We think it’s time for this to change.

Next up: We’re building CartaX and launching in 2020, pending regulatory approval.

Thank you to everyone who has invested, issued an option, or accepted a security on Carta. We hope to change how capital markets work, for everyone, for the better.

Want to help? Join our team of owners. We’re hiring on all teams, across the US and in Brazil.