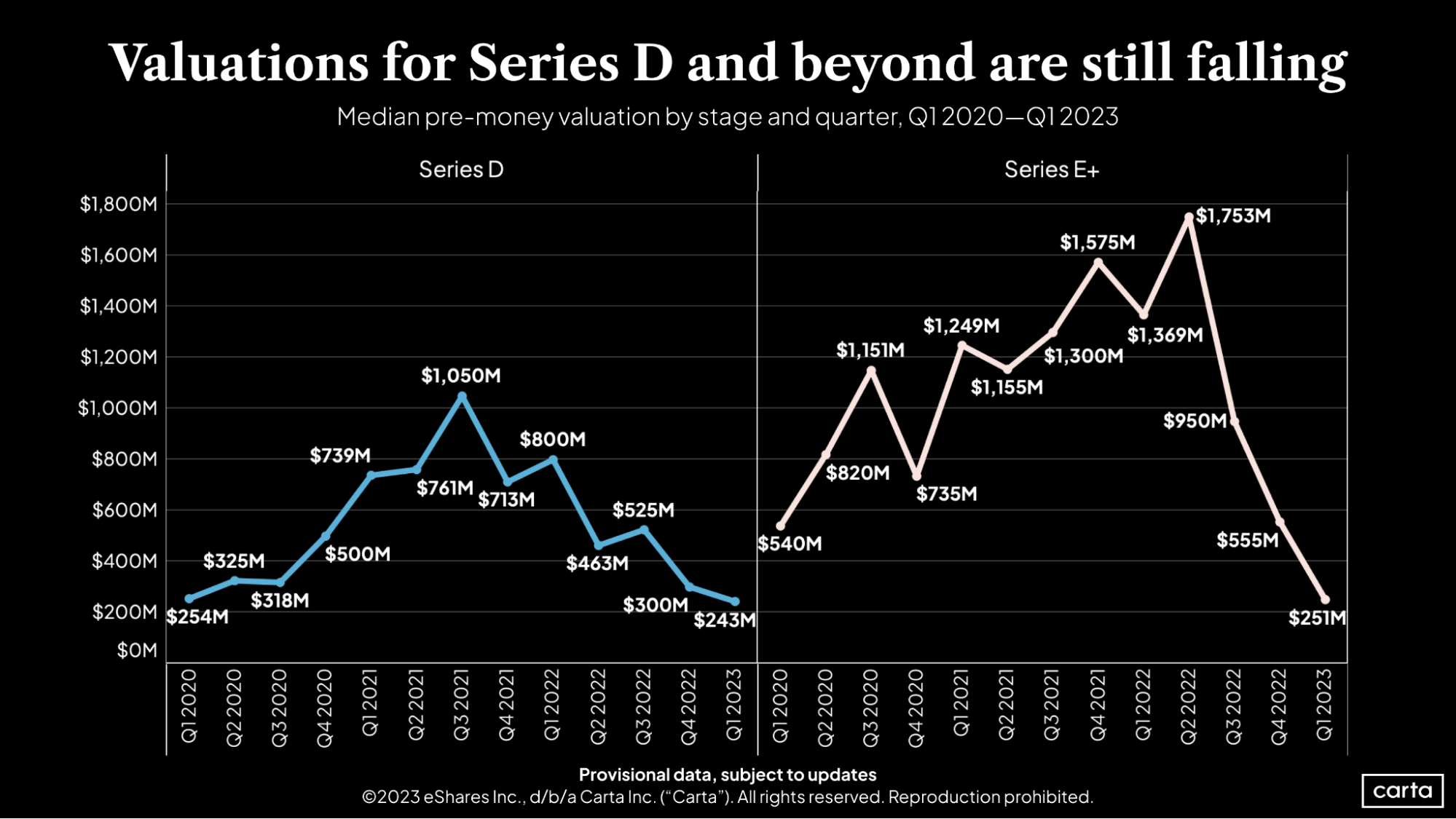

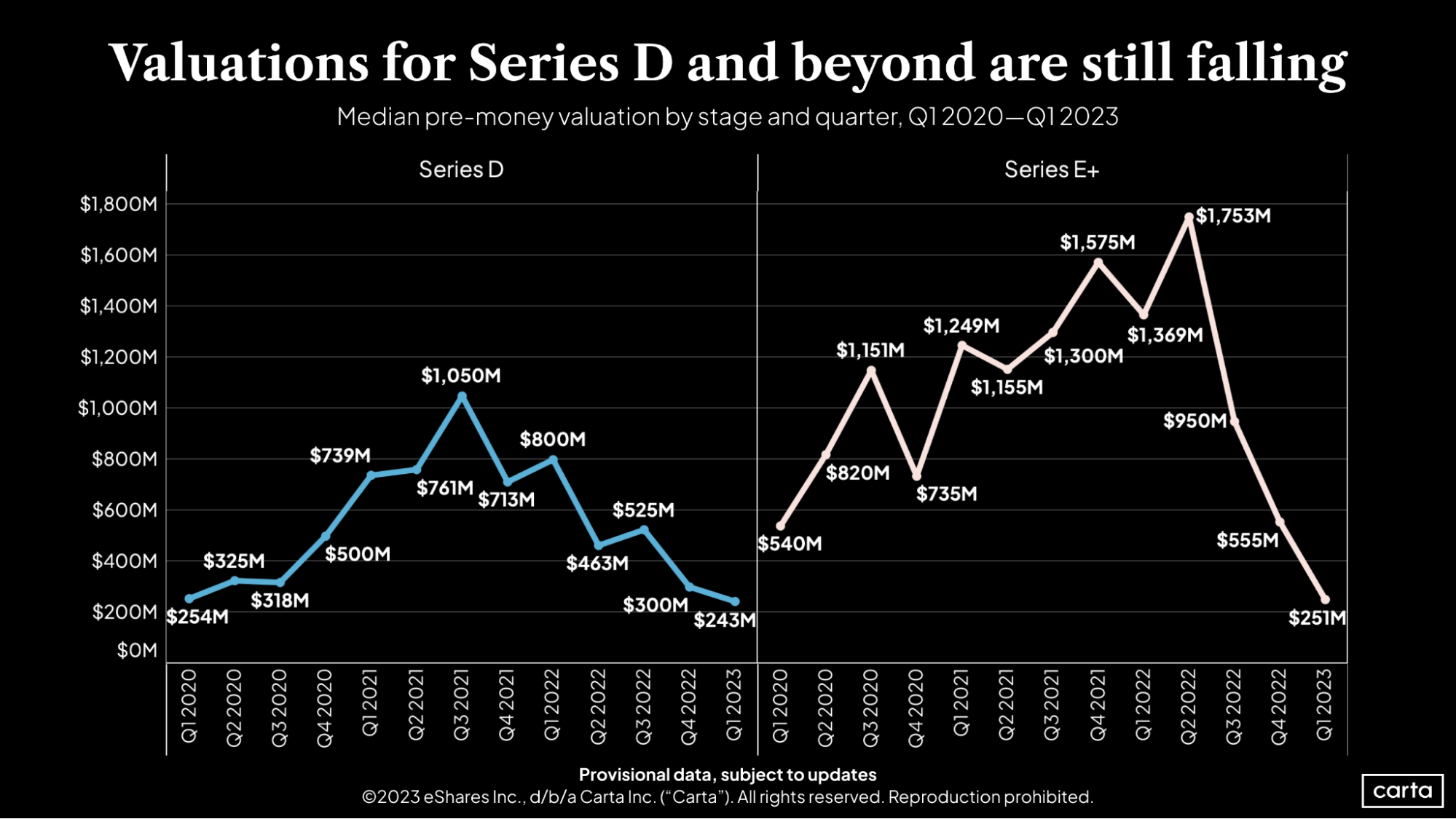

It was a difficult start to 2023 for late-stage startups hunting for new venture capital.

The median pre-money valuation in Series D deals fell to $243 million during the first quarter of the year, according to the first cut of Carta’s Q1 data. That’s down 19% from the fourth quarter of 2022 and down 70% on a year-over-year basis. The median pre-money valuation for deals at Series E and beyond, meanwhile, plunged to $251 million, down 55% from last quarter and 82% year over year.

These are the lowest quarterly figures in at least three years.

The venture capital market in late 2020 and 2021 was defined by rapidly rising valuations, particularly at these later stages. The market in 2022 was defined by an even more rapid reversal. What went up has now come down, and then some.

One reason late-stage private valuations climbed so rapidly in 2020 and 2021 is because valuations were also climbing for tech companies on the public markets. Trends in public valuations tend to trickle down to the private markets, particularly at later stages, because the goal for many mature private companies is to conduct an IPO in the near future and transition onto the public markets themselves.

The same logic held in 2022, even as the IPO market cooled considerably: As public tech valuations dipped, so too did private valuations.

But public and private diverged in the first quarter of 2023. The Nasdaq Composite gained 18% during Q1, and the Nasdaq 100 technology sector index gained 22%. Late-stage private valuations moved in the opposite direction.

For late-stage executives who might be trying to raise new funding in the months to come, those could be intriguing numbers. Public valuations tend to react more quickly to broader market shifts than private valuations. As such, public valuations are sometimes considered a leading indicator for what might come next in the private markets.

Venture investor Kamran Ansari, however, cautions against drawing too close a link between public and private markets. A former board partner at Greycroft and former head of corporate strategy and development at Pinterest, Ansari notes that public tech valuations fell further and faster last year than private tech valuations. Many private companies tried to wait out a slow market by postponing new fundraising efforts. Now, he sees public companies emerging from the worst of the downswing, while private companies that hoped to avoid a down round are being forced to grapple with the realities of a valuation reset.

“If a late-stage investor has a dollar, they are going to invest where they see the most opportunity, which in recent months has been the stable, established tech businesses in the public sector,” Ansari says. “The issue here is that the public markets already took their medicine, with many tech stocks down 60-70% from 2021 highs. This is a different dynamic from private companies, in which you only see a valuation change when the company goes out to raise a new round.”

The long fundraising timelines of the private markets mean that different startups are at different stages of their response to the downward shift in valuations. Many of those who raised recent rounds have, as Ansari puts it, already taken their medicine. Those trying to raise their first new round since the market shifted may still have a bitter pill to swallow.

Learn more

Get weekly insights in your inbox

The Data Minute is Carta’s weekly newsletter for data insights into trends in venture capital. Sign up here:

DISCLOSURE: This communication is on behalf of eShares Inc., d/b/a Carta Inc. (“Carta”). This communication is for informational purposes only, and contains general information only. Carta is not, by means of this communication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services nor should it be used as a basis for any decision or action that may affect your business or interests. Before making any decision or taking any action that may affect your business or interests, you should consult a qualified professional advisor. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Carta does not assume any liability for reliance on the information provided herein.

This post contains links to articles or other information that may be contained on third-party websites. The inclusion of any hyperlink is not and does not imply any endorsement, approval, investigation, or verification by Carta, and Carta does not endorse or accept responsibility for the content, or the use, of such third-party websites. Carta assumes no liability for any inaccuracies, errors or omissions in or from any data or other information provided on such third-party websites.©2023 eShares Inc., d/b/a Carta Inc. (“Carta”). All rights reserved. Reproduction prohibited.