For private equity firms and their portfolio companies, waterfall modeling often requires weeks of painstaking work from investor deal teams or members of a company’s finance department. Distribution rules in private equity operating agreements are complex. To make matters worse, everything is usually disconnected: Associates typically build waterfall models in Excel, but the operating agreement is usually in PDF format. In most cases the cap table is stored on yet another platform.

Carta’s new waterfall modeling feature centralizes and simplifies the process. We created a customized, connected tool to help private equity firms:

-

Automate quarterly valuations for LP reporting

-

Use exit modeling to evaluate the impact of a potential M&A transaction on returns for each stakeholder

-

Calculate estimated equity values for employees and investors at any time

Finance teams at privately held companies can also use the tool to estimate the value of employee holdings and determine proceeds for employees in the event of a completed sale.

Here’s what you can expect:

Dedicated, individualized service

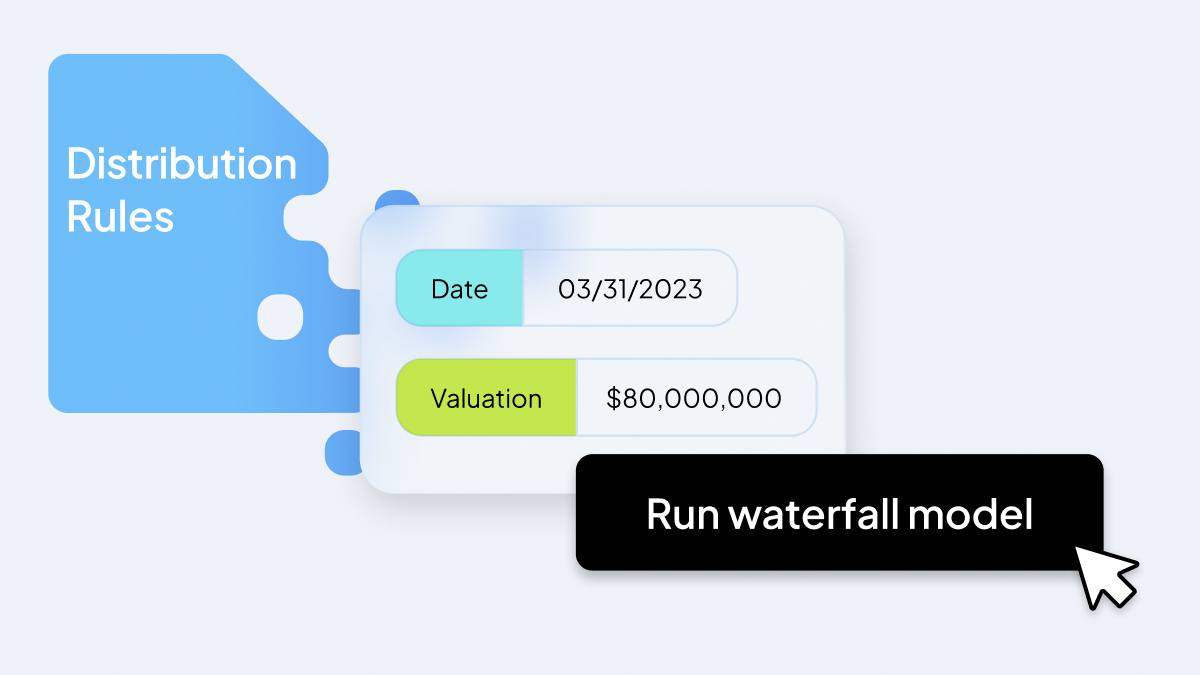

After you sign up, a Carta engineer will review the operating agreement and Excel-based waterfall for the company you’d like to analyze and schedule a conversation with your team. After the intake conversation, our engineers will encode the distribution rules in the operating agreement into a bespoke waterfall model that’s connected to the company’s cap table.

Once we’re finished, we’ll demo the waterfall modeling tool for your team and answer any questions. You can then use the tool to run as many waterfall analyses as you need to, and as often as you like.

A connected waterfall to increase accuracy

One of the things that makes PE waterfall modeling difficult is the number of variables involved: Projected proceeds for executives and employees are based on fluid parts of the cap table, such as vesting schedules and performance-based incentives. If a company’s cap table is out of date, waterfall distributions will be inaccurate, too.

By integrating with the portfolio company cap table, Carta’s waterfall modeling tool automatically accounts for performance-based incentives and vesting schedules. The interconnectivity reduces opportunities for human error and increases the accuracy of distribution projections.

Our white-glove waterfall modeling service is available to all PE firms and PE-backed portfolio companies with cap tables on Carta.

Want to see it in action? Reach out to a member of our team for a demo.