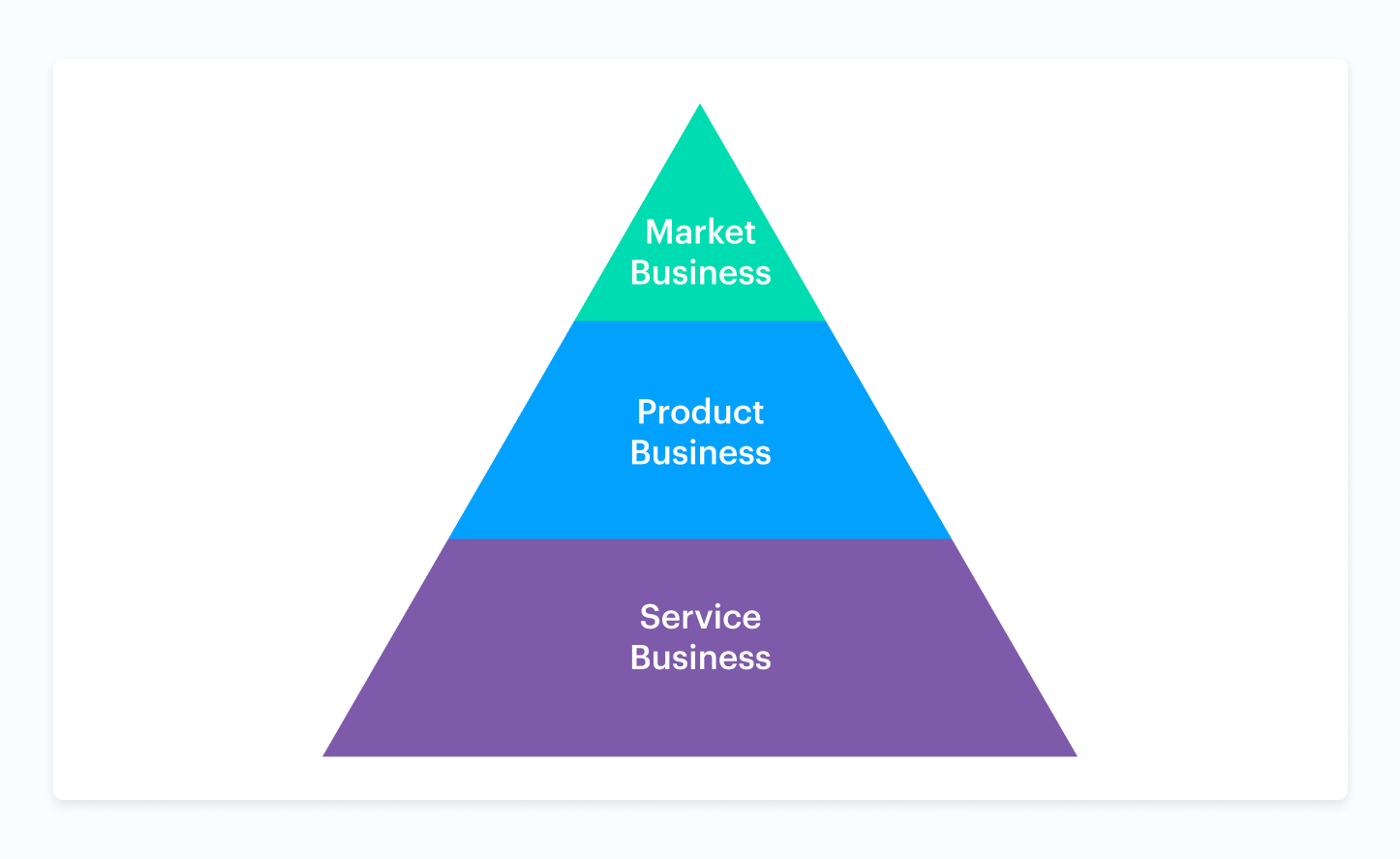

In 2018, Carta entered the fund administration business to fix a broken service industry. We believed that there was a better way to administer funds. By marrying service and technology, we set out to create a system of record for fund managers and their investors. In the last year, we’ve hired a world-class service team, and our R&D team has had the luxury of learning and observing as we’ve scaled. These learnings empower us to build the software solution to fund administration.

To start the Fund Admin business, we hired some of the best talent in the industry who brought with a wealth of knowledge about fund accounting. That knowledge provided us—those who build the products— an incredible opportunity to learn the nuts and bolts of fund administration from the inside.

As we built up this business, we prioritized R&D dollars on key differentiators. In venture, fund performance is a lagging indicator. This is further exacerbated by the fact that traditional fund admin shops only report data on a quarterly basis. The first feature we went to market with was Schedule of Investments, which allowed fund managers to track every investment’s cost and value in real-time. We’ve continued to expand on these real-time metrics through features like Deal by Deal IRR and a fund performance dashboard. These have allowed us to tell a compelling story about how technology could change the face of fund administration and win market share.

Learning from the service business

As the business gained traction, we focused on scale. By then, we had learned some important things about Fund Administration. First, that this was a relationship business. The accounting and treasury services were table stakes. The relationships our fund admin team fostered with our clients entrenched Carta into the lives of the fund managers. As product builders, we knew we had to create the space for the delivery team to double down on those relationships.

We understood things such as:

-

The breadth of what our fund admins do for our clients and how they think about anticipating client needs

-

The nuances of accounting

-

How different fund payout structures affect how metrics are calculated, i.e., American versus European Waterfalls

We found ourselves asking—how do we create meaningful leverage in the operations of our fund administration staff? The fund accountants were engaged in so many disparate tasks and were leveraging multiple systems, with multiple touchpoints. We needed to consolidate their workflows in one place and automate repetitive, predictable, and deterministic tasks. Enter Event-Based Accounting, Carta’s answer to scaling fund administration.

Scaling through an integrated platform

When an event happens in a fund that impacts the fund’s accounting, fund administrators will find out about the event through fund managers, portfolio companies, and bank syncs. We will build product workflows that allow us to capture the event and pertinent data about that event in our application. These workflows will incorporate important parts of the quality assurance, audit, and review steps that fund admins are manually managing today.

When the event is recorded in Carta, the platform will automatically trigger transactions in the general ledger. The journal lines in the ledger are linked to entities in Carta –i.e. funds, GPs, LPs, portfolio companies, and investments. This linkage is essential for all of the contextual, differentiated product experiences we hope to eventually build.

Lastly, all of the work products that the Fund Admin team produces for GPs and LPs will need to be automatically built on top of these journal entries in the General Ledger. The review and publishing of these outputs will be facilitated by the product. All numbers will be auditable.

Much of the business logic that governs this flow of data comes from the legal documents associated with funds and their partners—LPAs, subscription documents, and side-letters. Key terms from these documents will be stored as structured data associated with the appropriate entity. When an event like a liquidation event happens, the product can reference these terms to determine how to queue up the distribution and book the resulting transactions.

Imagine this: GPs and LPs can click on any number on an in-app financial statement or a fund performance dashboard and trace back to the underlying journal entries and any mutations, such as allocations, that were performed on top of those entries. They can—at the click of a button—see the originating events and the legal terms that governed the business logic. They can even access the legal documents that prescribed the relevant transposition. These features would not only reduce human error and inspire trust, but LPs would never have to wonder whether an IRR calculation method from one fund was consistent with another.

Changing the game of venture

The earliest versions of accounting birthed the written word in ancient Mesopotamia. The foundation of double entry accounting was first documented by franciscan monk, Luca Pacioli, in the fifteenth century. This double entry system was the very underpinning of the Renaissance. The history of double entry accounting and capitalism are so interwoven, it is hard to imagine that one could exist without the other. We believe that we are at the crossroads of the next step function change in humanity.

Fund managers get into the business of investing to find the great companies of tomorrow. They are passionate about nurturing companies that can change the world while generating great returns for their LPs. We hope that the data platform we are building will empower fund managers to think more long-term.

Liquidity options on private company cap tables give founders the ability to stay private and think strategically about the future of their companies. We believe we can do the same for venture funds. If fund memberships were more liquid, could we obviate 10 year terms on funds? Could we better align the interests of founders and their investors? Can we inspire true innovation through longer-term bets and empower founders to build generational companies. Maybe. Just Maybe.

All we know for now is that Fund Administration is broken and we are going to fix it. Join us.