QSBS attestation

Optimize your equity tax benefit with QSBS

Pay fewer taxes on your equity and increase stakeholder profits with the Qualified Small Business Stock (QSBS) tax exemption.

- Establish your company’s eligibility dates

- Easy qualification process

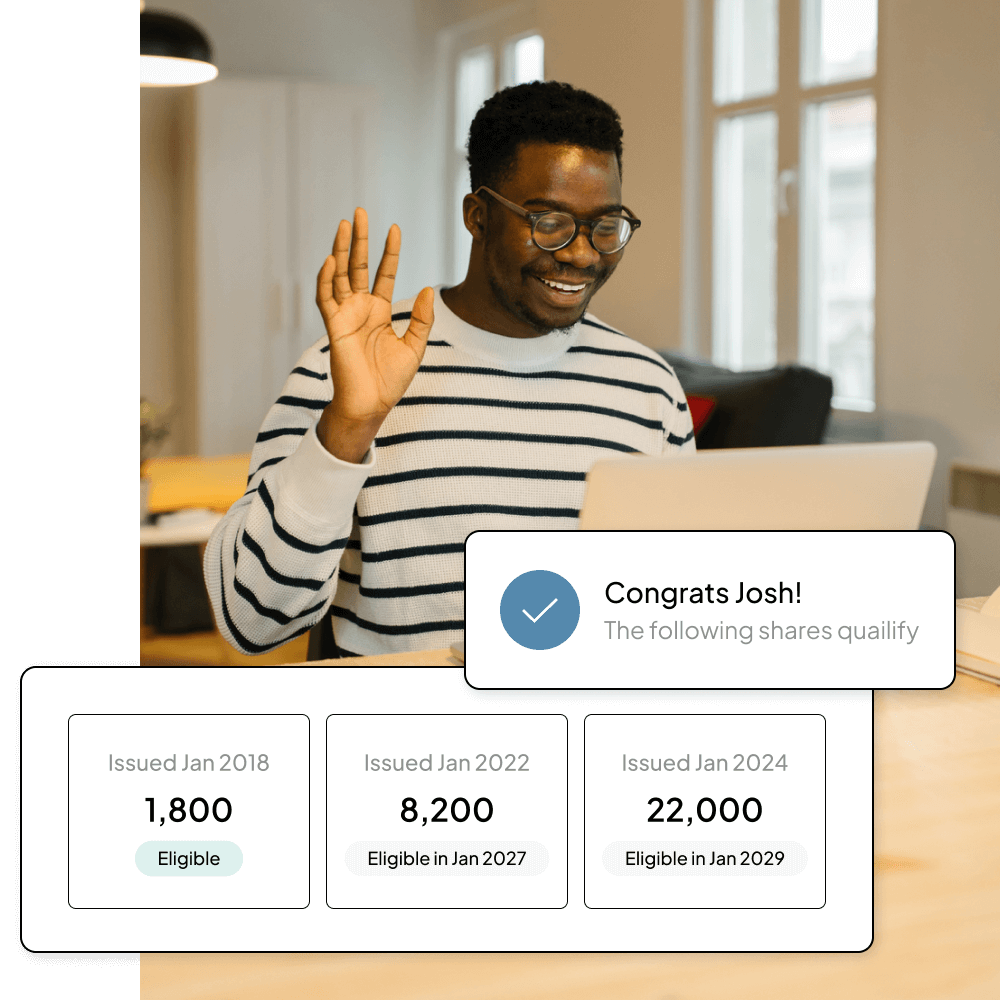

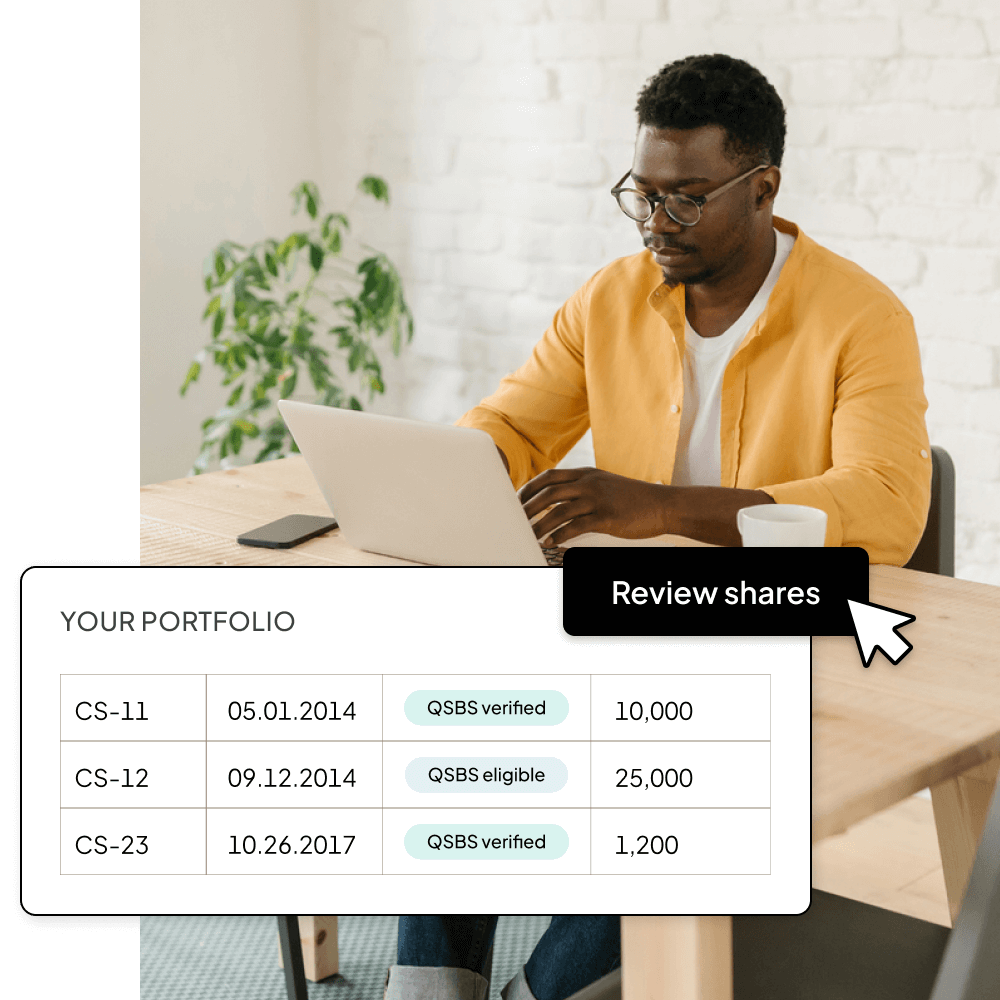

- Detailed list of eligible securities

- Centralized admin dashboard

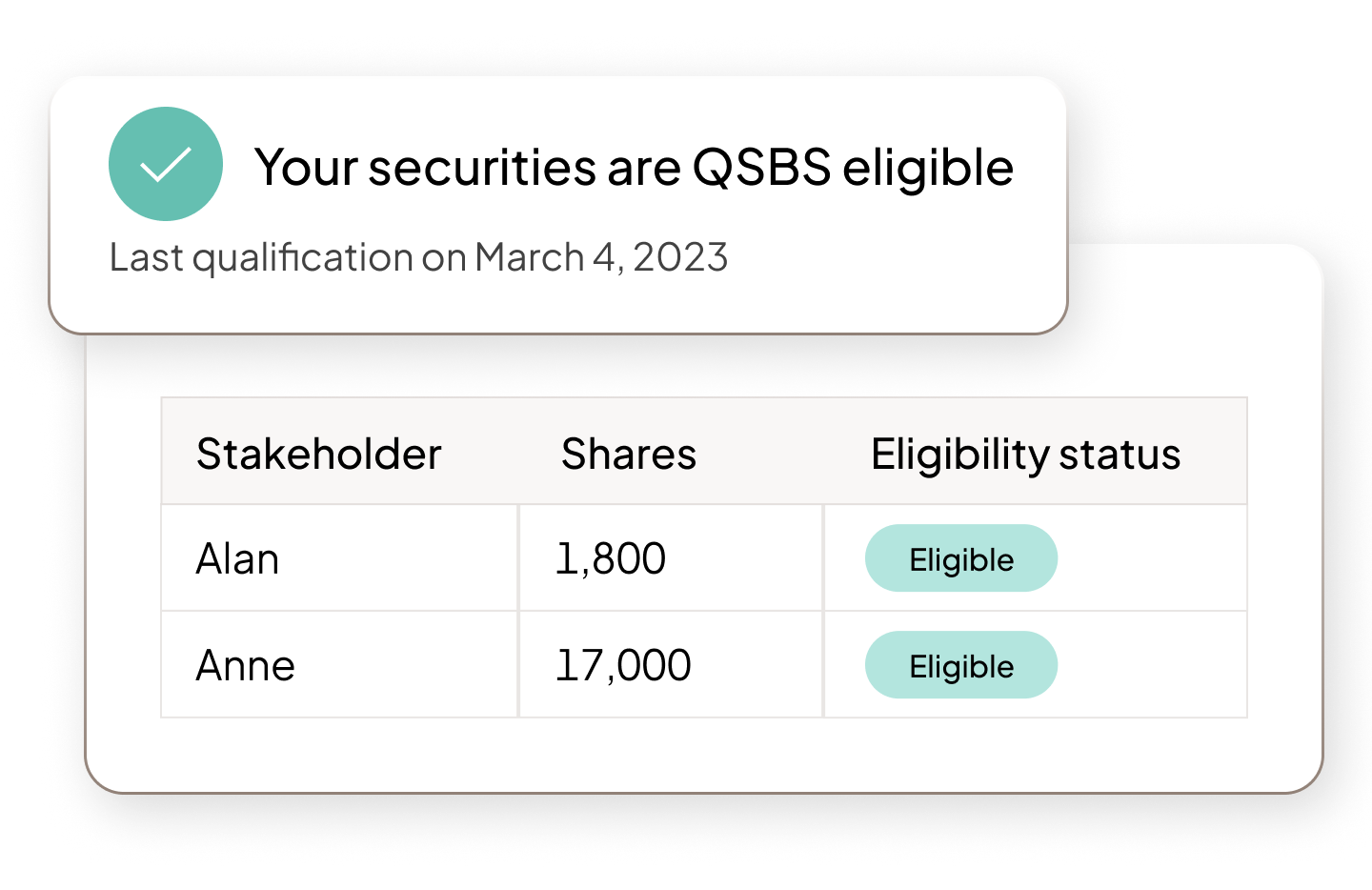

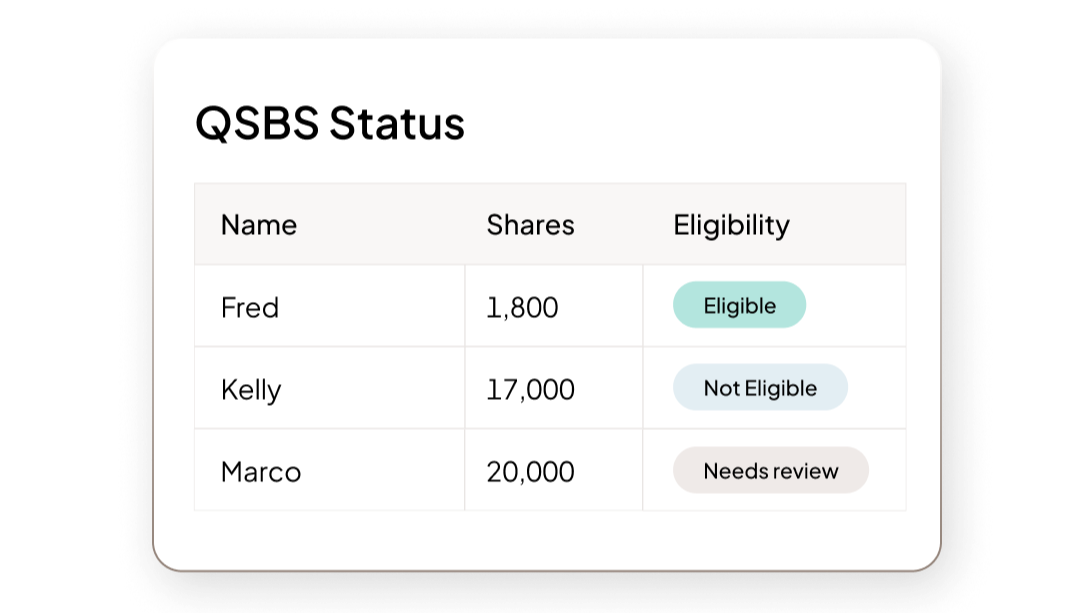

- In-product tagging of eligible securities

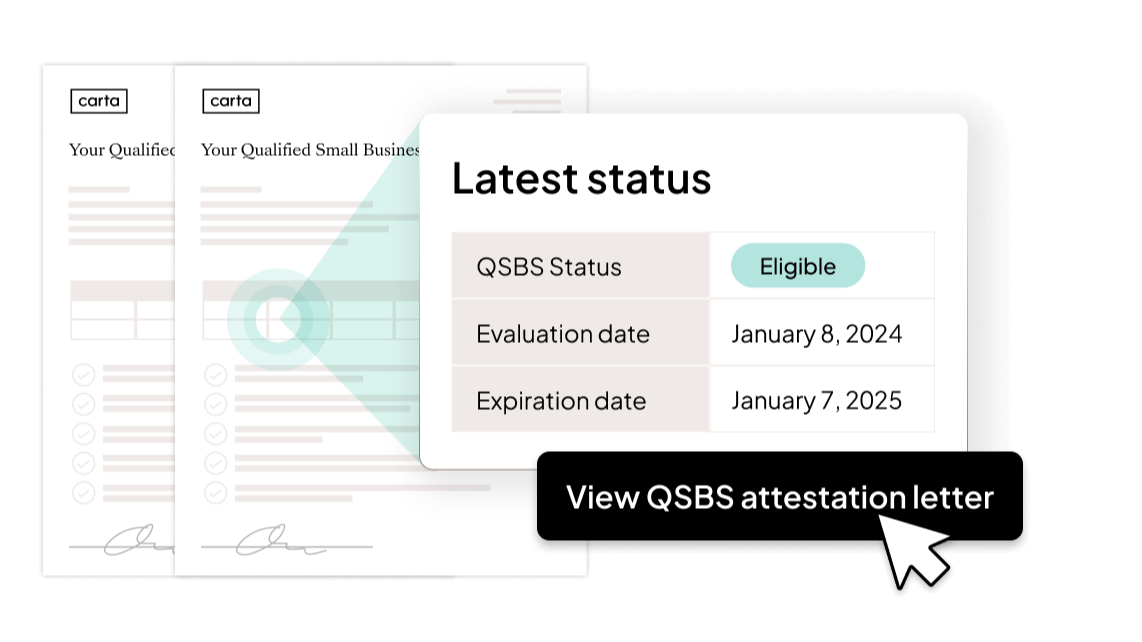

- Personalized QSBS letters

- Automatic eligibility checks with every 409A

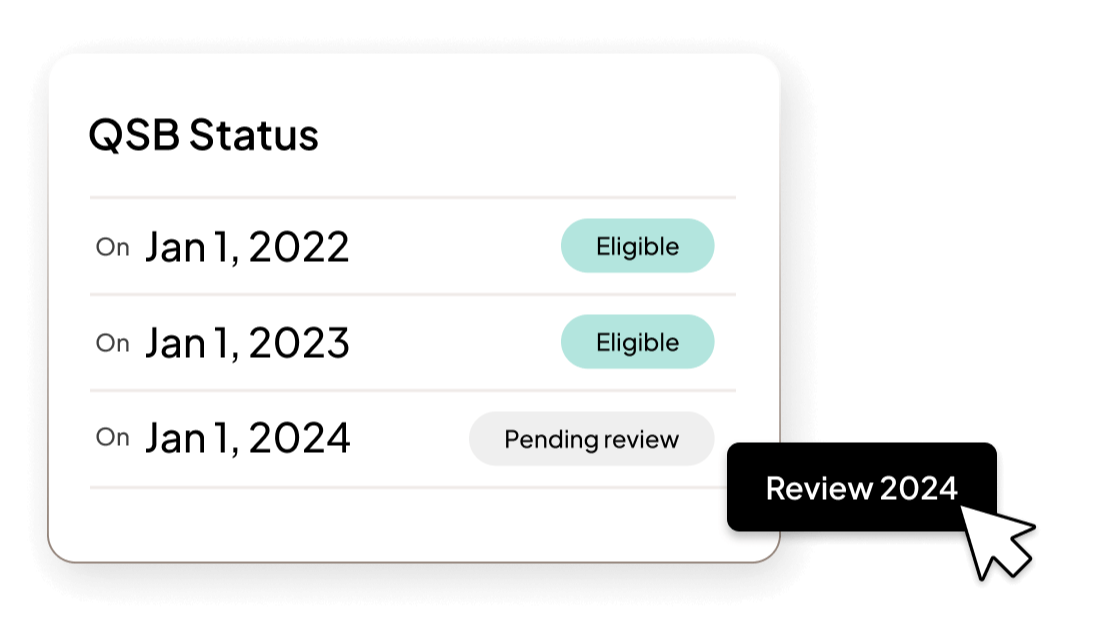

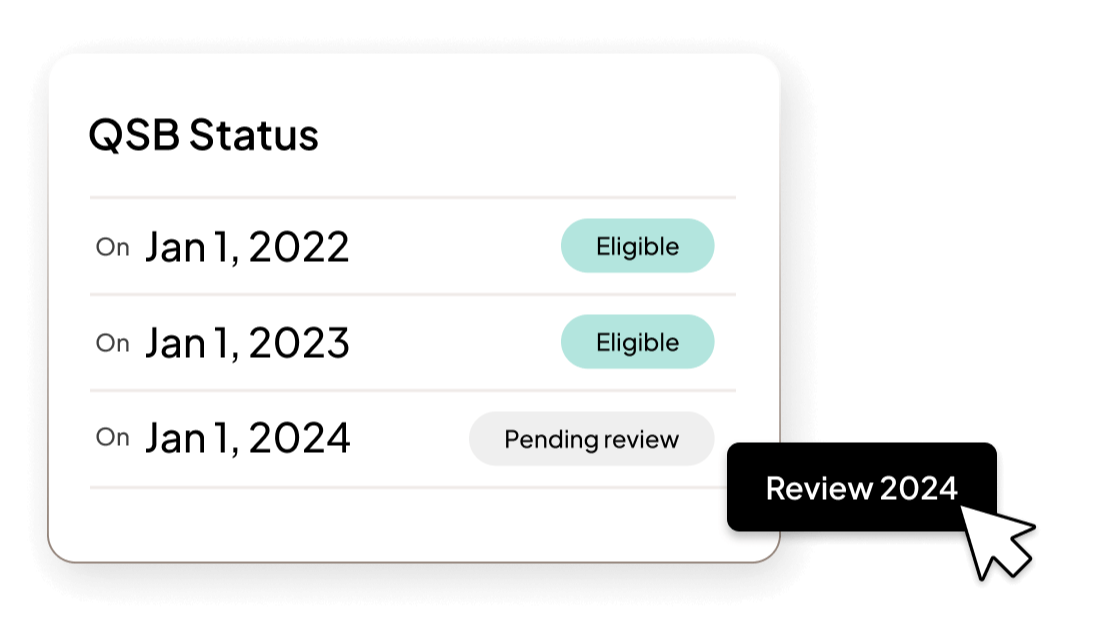

- Access records of previous assessments

- Unlimited support for maintaining QSB-status

What is QSBS?

Understand what the Qualified Small Business Stock tax exemption is, and why it's so important.

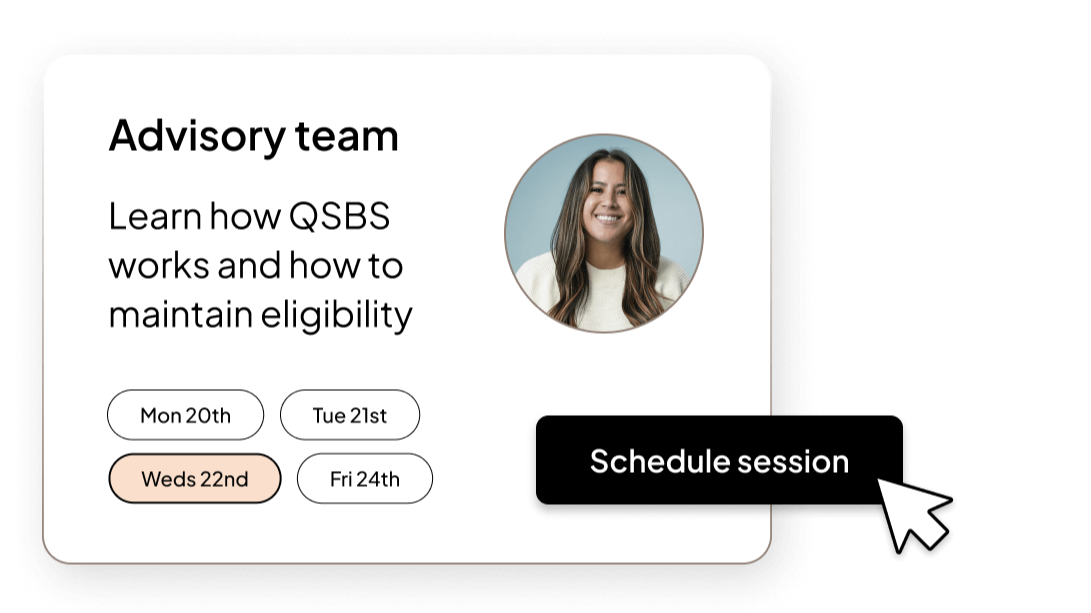

Navigate QSBS benefits with the experts

Trusted by over 40,000 companies

Related resources

FAQs

Do I need to be a Carta customer to access QSBS Attestation?

Yes, you need to be onboarded onto Carta to request QSBS Attestation. Learn more about pricing and plans here .

How can I verify QSBS eligibility?

Carta’s team of tax experts reviews your QSBS eligibility for you – so that you can be 100% certain you qualify before making important financial decisions.

If you are eligible, you can see which shares qualify directly from your dashboard after your attestation letter is issued.

Why should I get a QSBS eligibility review annually?

A company’s QSBS status can change if it receives additional financing, expands into a new product line or service, or conducts a secondary sale, such as a tender offer to repurchase shares.

How will a QSBS attestation letter help me stay audit-ready?

Carta issues an attestation letter each year that you can attach to your tax returns to certify that your company was QSB eligible when you were issued your equity.

We then tag each security on your Carta portfolio to ensure you meet the five-year holding requirement.

What other tax related services does Carta offer?

Carta offers Equity Advisory that includes companywide webinars and one-on-one sessions with accredited Equity Tax Advisors to help your employees understand their equity’s potential. Learn more here .

Optimize your equity tax benefit

DISCLOSURE: This communication is on behalf of eShares Inc., dba Carta, Inc. (“Carta”). This communication is not to be construed as legal, financial, accounting, or tax advice and is for informational purposes only. This communication is not intended as a recommendation, offer or solicitation for the purchase or sale of any security. Features and pricing subject to change. Carta does not assume any liability for reliance on the information provided herein.

©2024 Carta. All rights reserved.