It was a slow first quarter of 2024 for startup fundraising, with the number of new venture rounds declining at five of the six primary fundraising stages tracked on Carta, spanning from seed to Series E+.

The lone exception? Series C, where deal count increased by 14% compared to the prior quarter.

It was part of an overall strong start to the year for Series C startups. In addition to the bump in deal count, total capital raised at Series C increased by 130% quarter-over-quarter, reaching $4.6 billion. The median Series C valuation jumped by 48%. And the median Series C round size rose by 36%.

Just about every notable fundraising metric at Series C had plunged during the past several quarters. In Q1, things were looking back up.

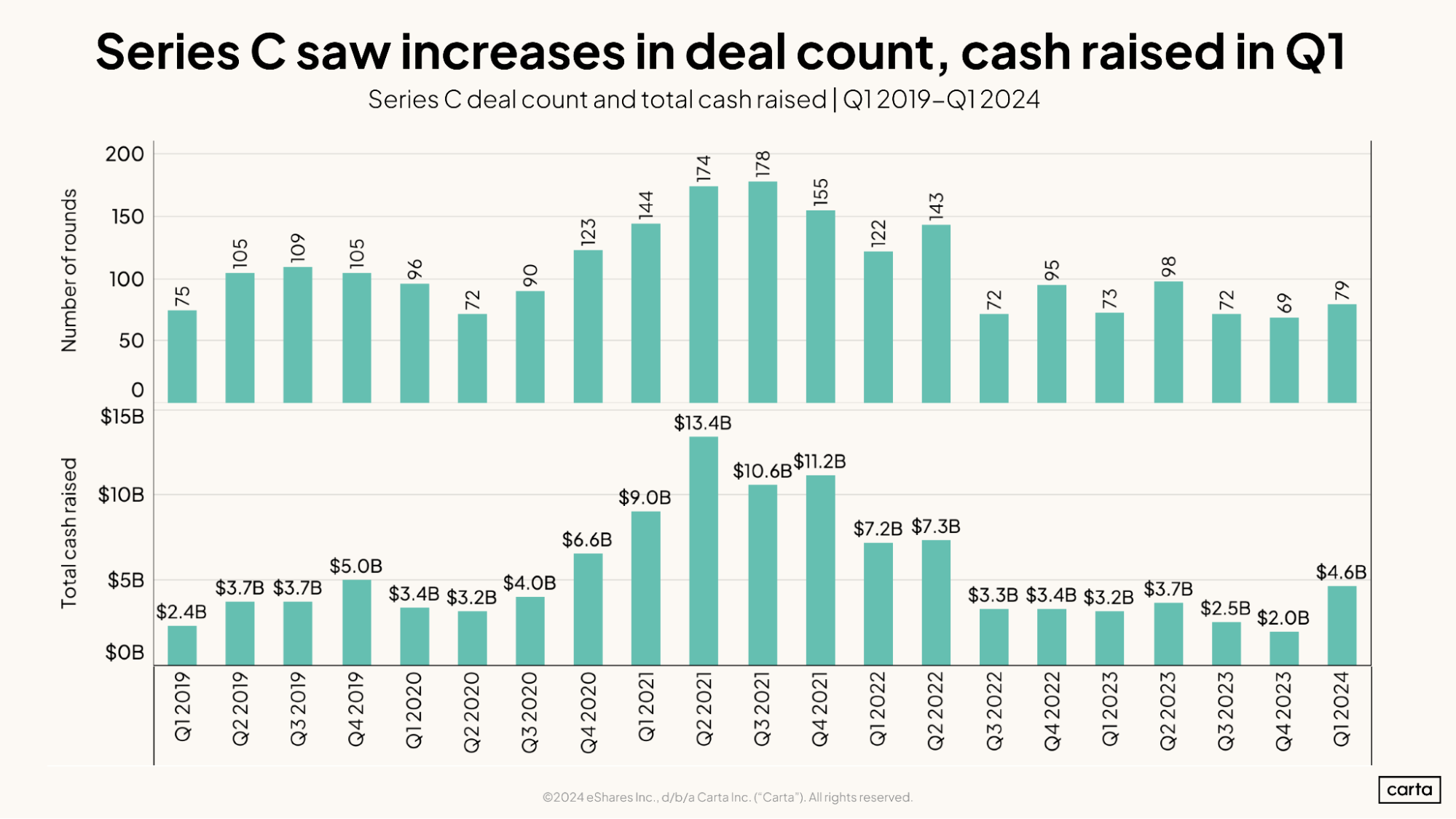

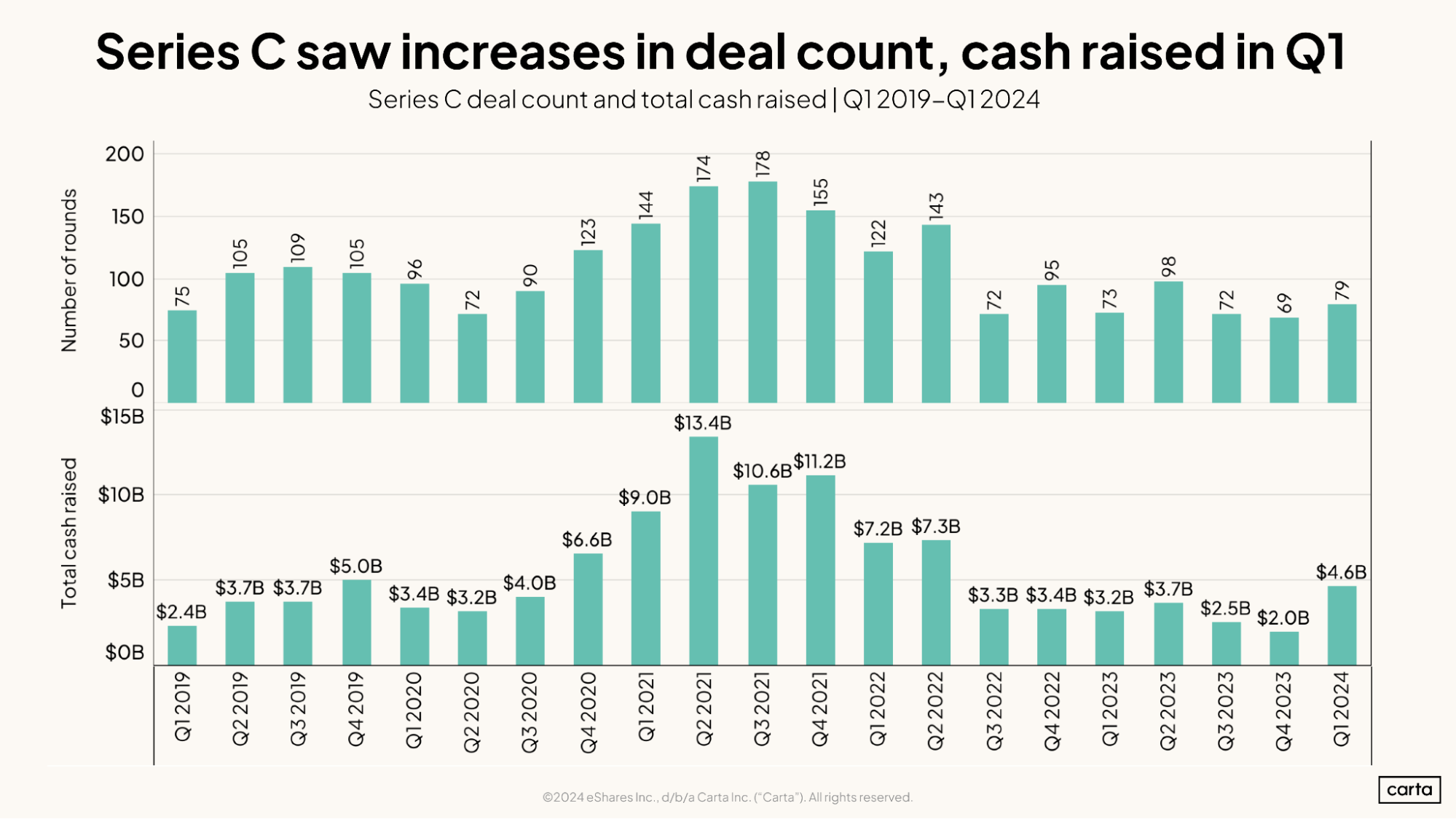

More deals, more dollars

Prior to Q1, Series C activity had been in a state of steady decline for more than two years. Quarterly deal count fell by 61% between Q3 2021 and the end of 2023, while cash raised went from $13.4 billion in Q2 2021 to just $2 billion in Q4 2023—a decline of 85%.

In that respect, Series C wasn’t alone. Deal counts and dollars raised declined at every stage of startup life during 2022 and 2023. At Series D and Series E+, the declines were even bigger than at Series C.

But Series C was alone in seeing these numbers rebound in a meaningful way to begin 2024. Deal count decreased at all five other main fundraising stages in Q1 (seed, Series A, Series B, Series D, and Series E+), and capital raised decreased at four of the five. At Series B, capital raised went from $4 billion to $4.2 billion, a modest 5% uptick—a far cry from the 130% increase that occurred at Series C.

A rare increase in round sizes

Series C round sizes saw some much-needed growth in Q1, with the median cash raised climbing from $15 million to $20.4 million. But that only made a small dent in the declines that occurred over the past few years.

From Q2 2021 through Q4 2023, the median Series C round size got smaller in eight out of 10 quarters. Over that span, the median round size declined by a total of 75%. With the increase in Q1 2024, median round size is now down about 61% from its recent high—still a big drop-off, but not quite as steep.

With round sizes so much smaller than they used to be, many Series C startups have had to reconsider their budgets and work to stretch each dollar further. This need for capital efficiency has been compounded by the fact that startups are waiting longer than they used to before raising a Series C: The median wait time between a Series B and Series C round on Carta was 805 days in Q1 2024, up 14% year-over-year and 31% compared to two years ago.

The average size of Series C rounds on Carta in Q1 was about $58.2 million. That’s the highest it’s been since Q1 2022, when the average Series C was about $59 million. The gap between the median and the average indicates that some Series C startups have still succeeded in raising much larger rounds, in some cases totaling $100 million or more.

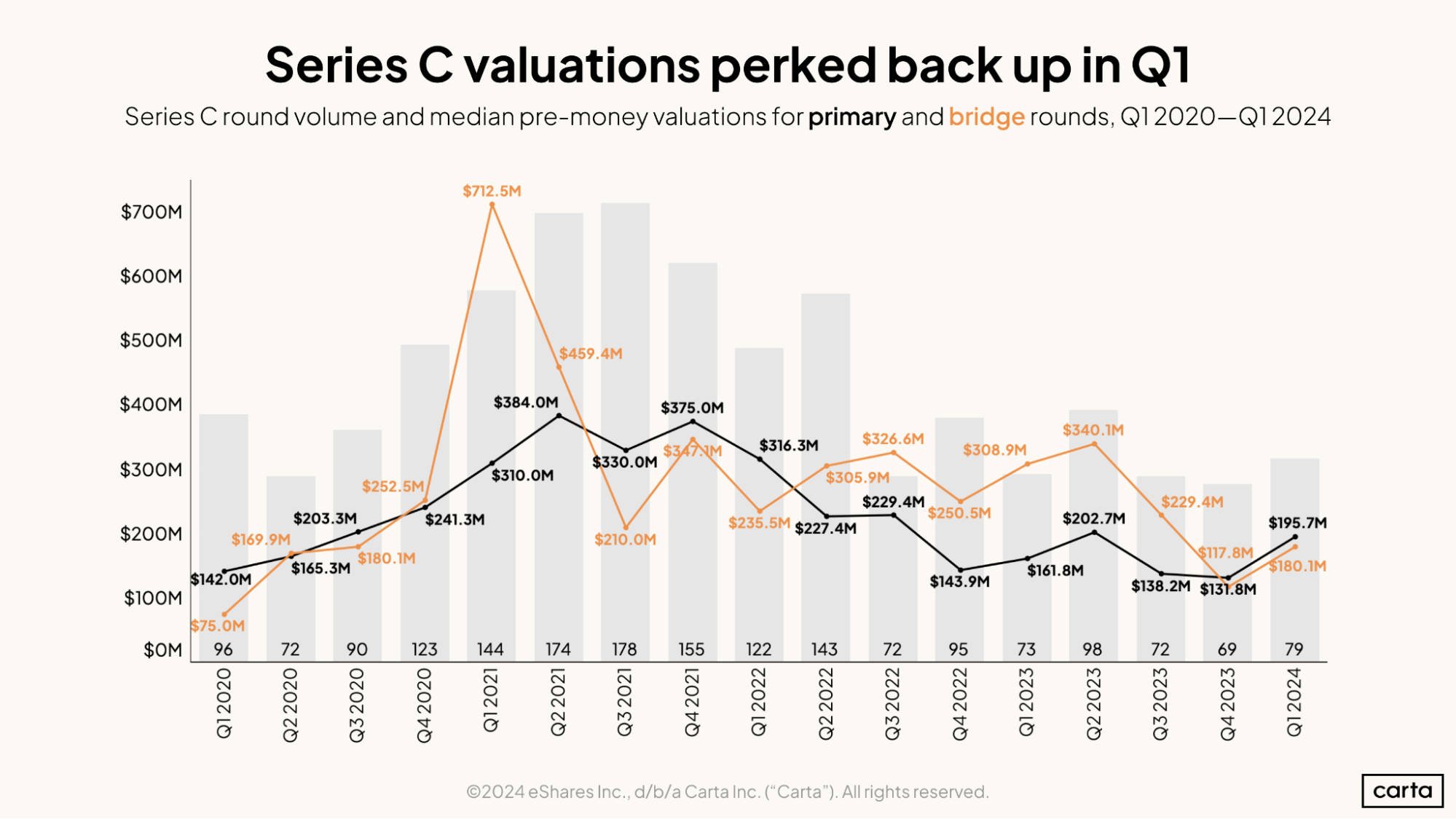

Median valuation nears $200M

As was the case with round sizes, Series C valuations had sunk to a new recent low in Q4 2023, with the median primary valuation settling at $131.8 million. And as was the case with round sizes, Q1 2024 brought a notable bounceback. Last quarter’s 48% growth was the largest percentage increase in the median Series C valuation in any quarter so far this decade.

The median valuation in bridge rounds at Series C took a similar jump in Q1, rising from $117.8 million to $180.1 million—a 53% increase. The median primary Series C valuation has now been higher than the median bridge Series C valuation in consecutive quarters. Before that, the median bridge valuation had been higher for six straight quarters.

Get the latest data

For the latest data on venture capital fundraising, startup hiring, compensation benchmarks, and more, sign up the Carta Data Minute: