- Artificial intelligence policy—the US v. EU

- Topline

- AI deep dive: comparing regulation in the U.S. and Europe

- Court “forum shopping” in CFPB challenge may impact other challenges

- California continues to lead on venture

- News to know

- Upcoming events

- Sign up below to receive Carta’s Policy Weekly Brief:

Topline

-

AI deep dive: comparing regulation in the U.S. and Europe

-

Court “forum shopping” in CFPB challenge may impact other challenges

-

California continues to lead on venture…and how policy can broaden reach

AI deep dive: comparing regulation in the U.S. and Europe

Creating sensible policy concerning artificial intelligence (AI) remains a top priority for policymakers in both the United States and Europe, but their approaches and progress have varied. Last week, the EU Council approved its landmark EU AI Act following approval by the European Parliament in March. The EU’s new AI policy is the first law to regulate general-purpose AI systems, and will apply to companies that operate in the 27 EU member states (regardless of where the company is headquartered).

In the United States, progress on AI policy has been slower and more fragmented. The primary driver of federal AI policy is the Biden Administration’s Executive Order on Safe, Secure, and Trustworthy Artificial Intelligence from October 2023. The executive order primarily focused on adapting the federal government to use AI for efficiency and ensuring AI doesn't introduce new biases or security concerns into public sector work.

Looking at the two primary policies governing AI in Europe and the U.S., there are some key differences between the two approaches:

Key differences between the EU AI regulation and US AI regulation

|

EU AI Act |

Biden Executive Order | |

|

Coverage |

Directly applies to any provider of general-purpose AI models operating within the EU |

Instructs federal agencies but doesn’t impose regulation |

|

Legal status |

Can only be repealed by the EU parliament or struck down by a court |

Can be revoked by another president or found unconstitutional by a court |

|

Threshold for risk |

A lower computing threshold means the Act covers a broader range of AI models, likely including some already in use by Google and Microsoft |

A higher computing threshold means that no existing AI model is known to exceed the U.S. threshold |

|

Ambition |

Aims to be the global standard |

Focused on domestic agencies |

While the current state of federal AI policy is less comprehensive than the EU, particularly in regards to the applicability to the private sector, there has been movement on AI policy at all levels of government within the United States:

-

Senate AI working group roadmap: Earlier this month, Senate Majority Leader Chuck Schumer and a bipartisan Senate AI Working Group released a roadmap for artificial intelligence policy. The roadmap notably places a large emphasis on funding research for AI innovation, and has been criticized for vague language on preventing AI-exacerbated bias. Schumer hinted legislation may move as soon as this year, noting the Senate will advance individual provisions as they are ready, rather than wait for a comprehensive bill to come together.

-

State legislation: To date, over 25 states have introduced AI laws and continue to push forward with their own AI legislation to fill the gaps evident at the federal level. Last week, Colorado Governor Jared Polis signed into law legislation that regulates the private sector’s use of AI in decision-making processes. The bill implements discrimination protections for consumers when AI is used for “consequential” decisions by requiring those deploying these types of high-risk AI systems to create a notification and risk management regime.

-

Federal agencies: In compliance with the Executive Order, federal agencies have had to turn their attention to AI. We have seen this across the government, including at the SEC where the Commission proposed an overly broad rule that would cover a wide array of technological tools seemingly beyond AI; the proposal was met with bipartisan pushback based on its breadth and the SEC is likely to modify and re-propose.

Court “forum shopping” in CFPB challenge may impact other challenges

A Texas judge transferred a case brought by industry against the Consumer Financial Protection Bureau from Texas to DC, observing that industry is using tenuous ties to the region to have its case heard in a more favorable jurisdiction. This is the latest in a long and high-profile debate over “ forum shopping” and “judge shopping”—the strategy of bringing suit in a jurisdiction believed to be the most inclined to deliver a favorable outcome to the plaintiff.

Why it matters: Forum shopping is increasingly prevalent in attempts to undo agency rules and nullify underlying statutes. Plaintiffs have carefully selected conservative courts to hear many pending challenges to Biden administration rules, including the Private Fund Adviser rules (Fifth Circuit); the Corporate Transparency Act rules (Alabama); and, as noted above, the CFPB’s credit card late fee cap (Fifth Circuit). As agencies promulgate and finalize more rules targeting the private market ecosystem, industry groups are likely to challenge them; the ability (or lack thereof) to pick which court in which these challenges are heard could have an outsized impact on whether the rules stand—and how they impact the VC and PE ecosystems and the portfolio companies they invest in. In addition to the pending PFA challenge (as of this writing) and the litigation on the SEC’s ESG rule, expect additional legal challenges if the SEC finalizes its asset custody rule and its artificial intelligence and predictive data analytics rule, which deals with how AI is used by broker-dealers and investment advisers.

What to expect: In mid-March, the Judicial Conference of the United States—the policymaking body for the federal court system—released new guidelines intended to crack down on “judge shopping.” The guidelines would require randomized assignments for cases focused on government policy and break the longstanding practice of assigning judges based on the geographic district in which the case is filed—but the guidance is nonbinding. In short: there is no fix on the horizon for forum shopping.

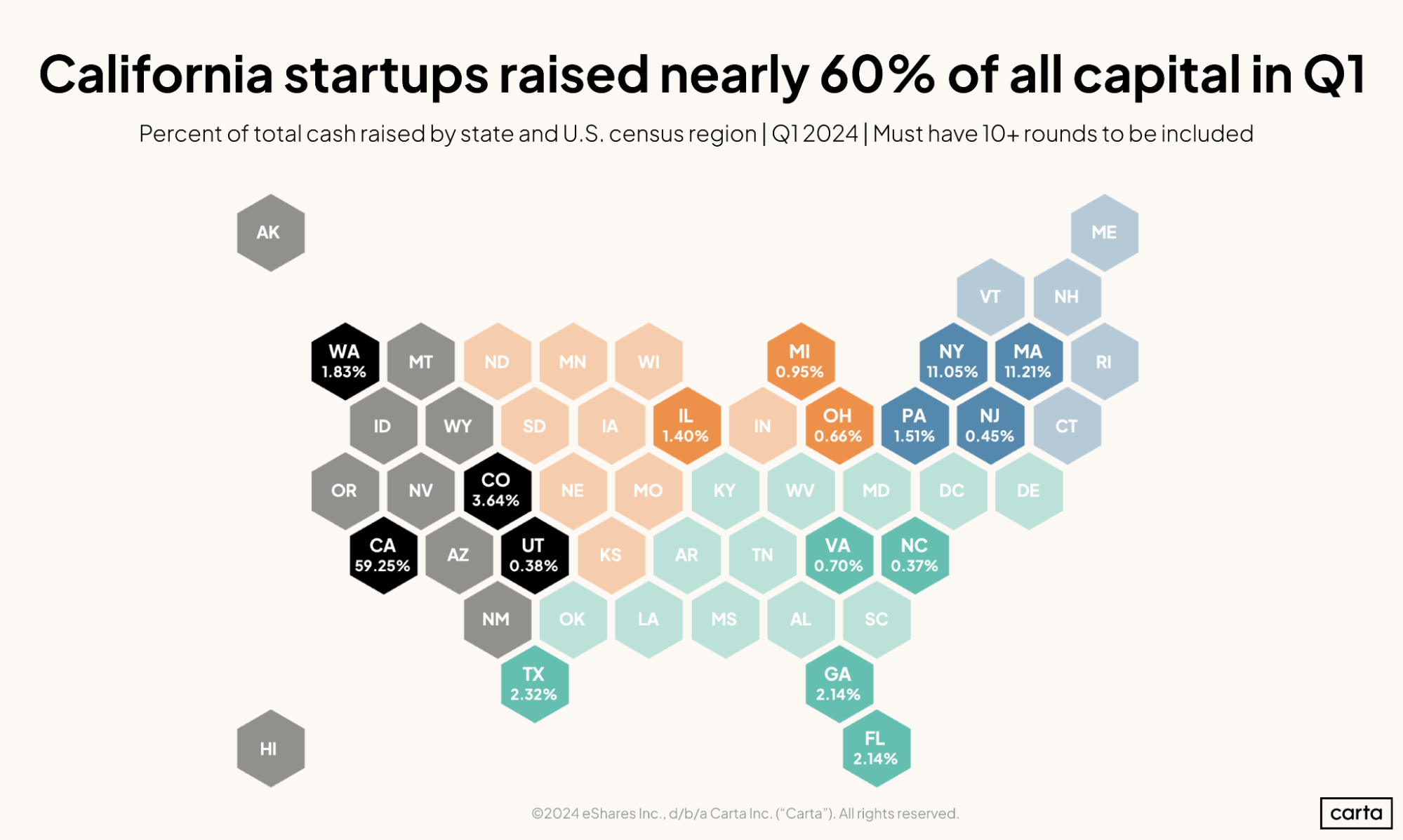

California continues to lead on venture

California raised about 60% of all venture capital in Q12024. The West’s total share rose to 62%, an 11-point increase since last quarter. This increase came at the expense of other regions: the Northeast, South, and Midwest all saw a dip in their share of venture dollars raised.

Why it—and policy—matters: We need to broaden the reach of venture to expand this innovation and economic engine to more people and places across this country. Policy may not be a panacea, but it can help. Many startups raise their first capital through angel investors and emerging fund managers. This is especially true for startups that are outside of traditional hubs and lack access to the more established VC channels.

Policy can help nurture emerging VC ecosystems across the country, including by:

-

Expanding onramps to become an accredited investor: The accredited investor definition is a national standard that determines who is eligible to invest in private assets based on wealth and income. Appropriately expanding the universe of accredited investors by adopting regional thresholds and increasing avenues to qualify through sophistication assessments will expand the base of capital for founder and fund managers, as well as provide more investors access to the investment returns in private markets.

-

Bolstering capital formation for emerging managers: Help emerging managers—who are more likely to deploy into non-traditional hubs—attract capital through the DEAL Act, which will make it easier for emerging managers to raise money from other established VC firms.

Join our expert panelists on Tuesday, June 4 at 10 a.m. PT / 1 p.m. ET for a discussion on the current tax landscape and practical guidance for navigating upcoming changes that will have significant impacts on startups, venture funds, and other businesses. The panelists will cover:

-

An overview of expiring tax incentives and the expected impact on businesses (corporations and pass-throughs)

-

Strategies for adapting to the evolving tax landscape and maximizing existing tax benefits

-

Pending tax policy issues—and what Carta’s policy team is doing to support the innovation ecosystem

News to know

-

FCC Chair Proposes AI Disclosure Requirements for Political Ads (JD Supra)

-

New York regulator lays out customer complaint standards for crypto firms (Politico)

-

Elon Musk to testify in SEC probe over Twitter stock disclosures (Reuters)

-

IRS announces Direct File as permanent free tax-filing option starting next year (NBC News)

-

US Treasury report outlines potential financial risks of NFTs (Cointelegraph)

Upcoming events

-

June 4 - Carta virtual event: Business Guide to Taxes: Expiring Tax Incentives

-

June 5 - House Financial Services Committee hearing: Next Generation Infrastructure: How Tokenization of Real-World Assets Will Facilitate Efficient Markets

-

June 6-7: U.S. Department of Treasury: 2024 Conference on Artificial Intelligence & Financial Stability

-

June 7 - SEC: Investor Advisory Committee meeting on examining the new frontier for investment advice and discuss AI regulation